Gold Rampages to Safety Highs While Bitcoin Has a Craft Fag Out the Back

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

I do love a good sensationalised headline.

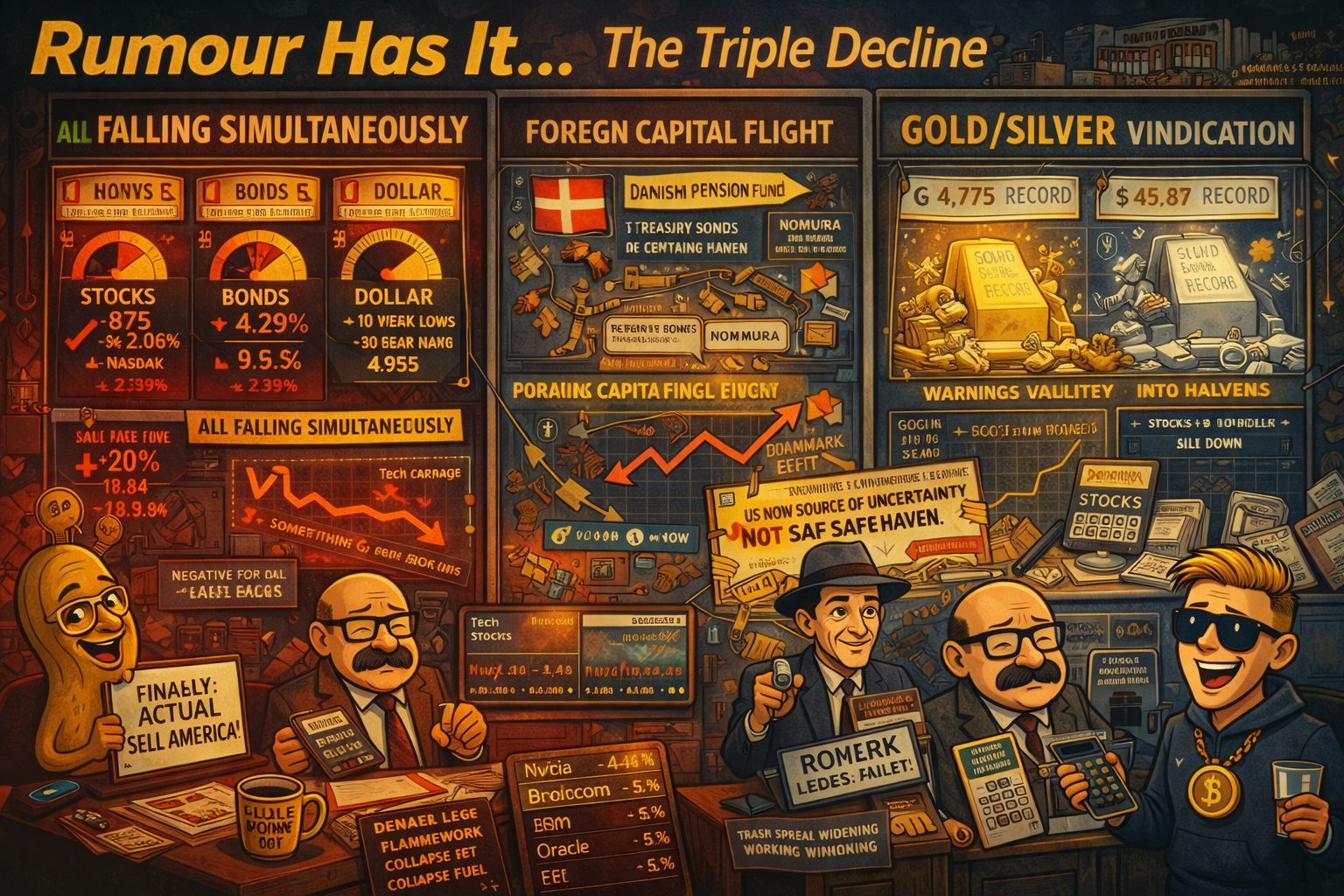

“Sell America Trade Finally Happens!” “Danish Pensions Exit!” “US No Longer Safe Haven!” The financial media is having an absolute field day with this one.

Now, I’m not saying I’m not enjoying the selloff – the bear swings from last week are paying out beautifully. But let’s pump the brakes on the apocalypse narrative, shall we?

These 1-2 day selloffs have been very short-lived over the last 12 months. Every single one. The “this is it, the big one!” headlines have appeared roughly seventeen times since last January, and roughly seventeen times they’ve been followed by “markets recover on bargain hunting.”

I will continue to trust the price action. Which does agree there’s more downside. But we are not crashing – at least not yet.

Yes, these moves are bigger than we’ve seen in the last 3-6 months from a price range perspective. But 1.5% moves? That’s the upper end of volatile market norms. Bearish? Absolutely. Crashing? We are not.

Keep scrolling – the charts tell a calmer story than the headlines…

When Headlines Scream, Systems Execute.

Market Briefing:

The Flight to Safety Scoreboard

Gold: On a rampage higher. Classic flight to safety behaviour. The precious metal doesn’t lie – when uncertainty spikes, gold catches a bid. Currently smashing through all-time highs at 4,891.

Bitcoin: Having a craft fag out the back while the adults panic. Once again proving it’s not the “new flight to safety” that crypto bros promised. When real fear hits, institutions reach for the shiny stuff, not the digital stuff.

Main Indexes: Continuing to slide as expected. Last week’s bear swings are starting to pay out exactly as the patterns suggested.

Current Multi-Market Status:

- SPX: TnT Bearish Below (Flipped) – Status 6833.29 – PFZ 6863.35 – Target Pending

- RUT: TnT Bearish Below (Flipped) – Status 2683.68 – PFZ 2688.63 – Target Pending

- ES: 6,840.50 – Target 2 at 6,675.25 in sight

- YM: 48,690 – Target 2 at 46,602 on radar

- NQ: 25,150.75 – Firmly in breakout move

- RTY: 2,664.4 – Clinging near highs, lagging

- GC: 4,891.1 – NATHs, rampage mode

- CL: 60.34 – Bouncing in channel

- VIX: 19.82 – Holding elevated levels

- BTC: 93,161.86 – Craft fag territory

- NYSE Breadth: -1,547,000 (very negative)

The Range Breakdown Analysis

SPX and Dow: Have moved from upper range to lower range and are now challenging breakouts. The journey from range highs to range lows is complete – now the question is: break or bounce?

Nasdaq: Has less distance to travel and is firmly in a breakout move already. Tech leading the charge lower, as it often does.

Russell 2000: Clinging on near the highs like a stubborn toddler refusing to leave the playground. Yet to move decisively back into the range.

I’m not seeing this as secret strength in the markets. RUT has a tendency to either lead the charge or lag the dive – doing its own thing most of the time. It’ll get there eventually.

My Setup Today

SPX at range lows and challenging a breakout. This is decision time.

I will continue to be cautious with the Tag ‘n Turns – which worked very nicely yesterday to avoid getting flipped and flopped. I’ve marked off the potential bull AND bear paths because at range lows there are always two choices:

Bull Path: Bounce from range lows, reclaim the range, work back towards highs.

Bear Path: Break through range lows, enter breakdown territory, extended move lower.

My new unofficial tool (soon to be integrated into the SPX Income System) on the lower chart area is telling me we have a strong trending move and momentum is still increasing.

A quick look at the overnight futures confirms we’ve broken yesterday’s lows – usually a sign of continuation.

RUT: The Laggard Setup

While lagging slightly, RUT is showing similar characteristics but looks more like a false bullish range breakout that’s now setting up for the break back into the range.

My new tool is also showing strong bear trending moves on RUT and has not exhausted yet. Conservative Tag ‘n Turn entries as needed – otherwise the bear remains.

Translation: RUT is about to play catch-up. I’m positioning accordingly.

The VIX Difference

Worth noting: VIX is holding its elevated levels compared to the last time it blipped higher. Previous spikes faded quickly. This one is settling in at the higher range.

That’s telling me the options market expects continued volatility. Premium sellers, take note – elevated VIX means fatter premiums to collect.

Expert Insights:

Bearish Isn’t Crashing

There’s an important distinction the financial media loves to blur: being in a bearish move is not the same as crashing.

A 1.5% daily move, while uncomfortable for the buy-and-hold crowd, is within normal parameters for volatile market conditions. We’ve seen these regularly throughout the last decade. They feel dramatic. They generate headlines. They mostly resolve.

The systematic approach doesn’t care about the narrative. It cares about the levels. Range lows are range lows. Breakout territory is breakout territory. The rules don’t change because a journalist found a catchy “Sell America” headline.

Trust the price action. Follow the patterns. Let the headlines entertain someone else.

In Other News…

“Sell America” Trade Finally Happens After Years of False Alarms

Stocks, bonds, dollar all decline simultaneously. Danish pensions exit. US “source of uncertainty, not safe haven.”

“Sell America” trade materialised Tuesday as Dow crashed 875 points (-1.77%), S&P fell 2.06%, Nasdaq dropped 2.39% whilst bonds sold off and dollar weakened creating genuine foreign capital flight not theoretical scenario analysts predicted annually. VIX jumped 20% to 18.84, 10-year yield spiked to 4.29% (highest since August), both S&P and Nasdaq now negative for 2026 proving Greenland tariff crisis produces actual consequences. Nomura declared “US now source of uncertainty, not safe haven”—fundamental shift from decades of American exceptionalism.

When Stocks, Bonds, Dollar All Fall Together

Tuesday’s simultaneous decline across stocks, bonds, dollar signals something genuinely broken not routine correction. Defensive rotation failed as bonds sold off alongside equities—no traditional hedge working. Danish pension fund exit announcement triggered Treasury selloff intensifying, 30-year nearing 4.95%, Japan’s 40-year hitting record sparking global bond contagion. Only gold miners outperformed as precious metals hit records validating warnings equity markets dismissed for months.

Tech Carnage: Results Don’t Matter Edition

Nvidia -4.4%, Broadcom -5.4%, Oracle -5.8% led tech rout whilst no sector spared proving broad-based selling not rotation. Netflix beat Q4 with $0.56 EPS, $12.05B revenue, 325M subscribers then fell 5% on Warner Bros deal concerns—perfect execution punished because framework uncertainty renders results irrelevant. 3M -7%, IBM -5% demonstrate even quality names can’t escape when foreign capital flees.

Gold $4,775, Silver $95.87: Vindication

Precious metals hit records as only assets working during simultaneous equity/bond/dollar decline. Gold $4,775, silver $95.87 prove warnings dismissed as background noise were accurate signals of institutional framework collapse. Flight-to-quality into haven assets not defensive equities demonstrates traditional portfolio construction broken when bonds fail simultaneously with stocks.

Foreign Confidence Erosion: Denmark Leads Exit

Danish pension fund exit announcement symbolises foreign capital reconsidering American asset safety. Credit spreads widening, dollar weakness supports commodities but signals confidence erosion not bullish devaluation. Nomura’s “source of uncertainty” quote captures fundamental shift where threatening creditors with tariffs whilst relying on financing creates predictable outcome.

☕ Hazel’s Take

“Sell America” finally happens, stocks/bonds/dollar decline together, Danish pensions exit, gold vindicated. When US transforms from safe haven to uncertainty source and traditional hedges fail simultaneously, probably acknowledging difference between analysts crying wolf annually and actual structural crisis materialising.

—Hazel, FinNuts

Rumour Has It…

Percy Peanut has declared this the “Sell America” trade and is frantically trying to sell his desk, his chair, and three packets of stale peanuts to anyone who’ll buy them. Hazel Ledger pointed out that’s not quite what the phrase means.

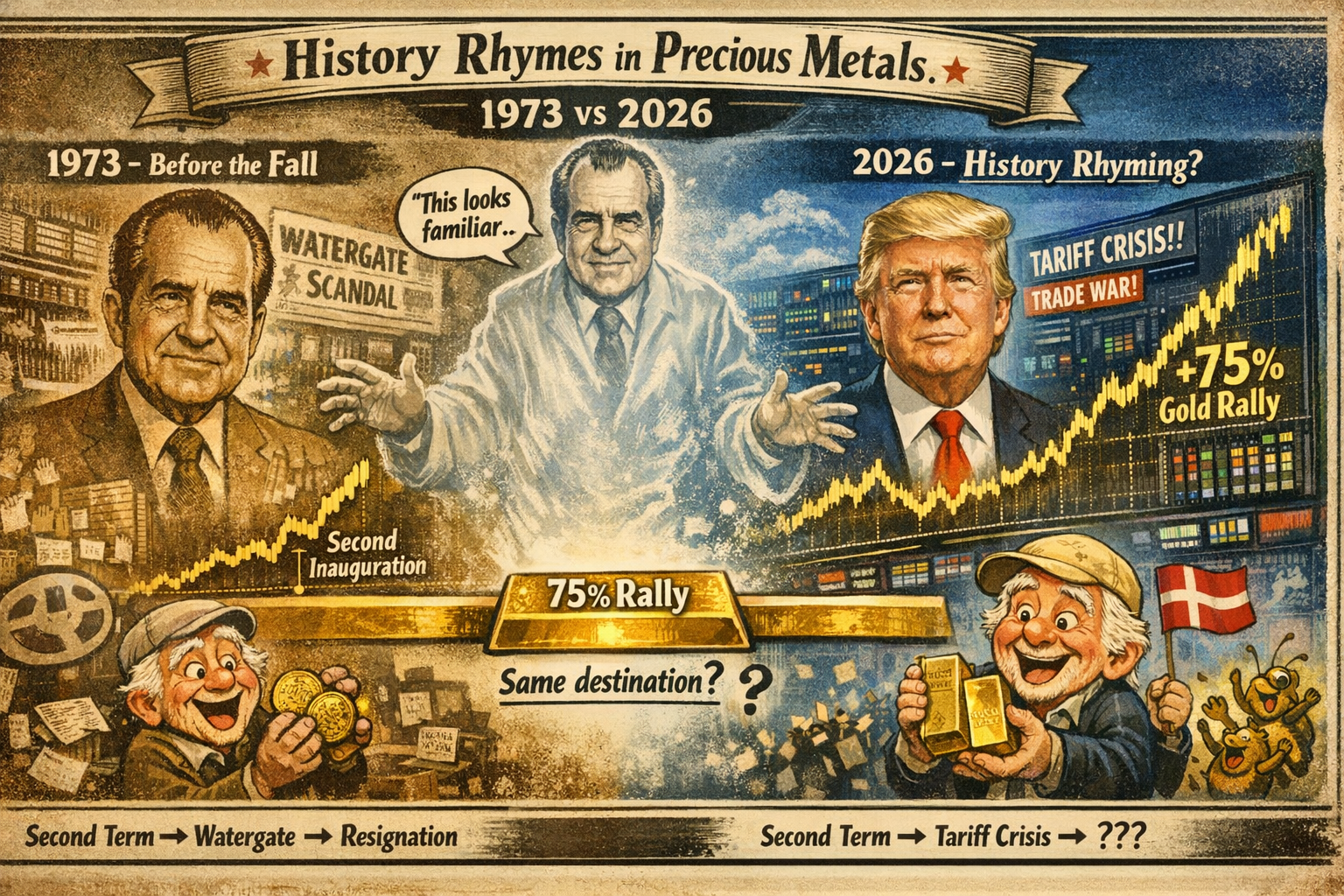

Wallie Winthorpe is muttering “I’ve seen this before” whilst polishing his 1970s-era gold coins. When asked if he thinks Trump will go the way of Nixon, he simply smiled and poured another measure.

Kash “Krash” Cashew is deeply offended by the suggestion that Bitcoin is “having a craft fag” during the crisis. “It’s consolidating for the next leg up!” he insists, whilst his portfolio shows otherwise.

Mac Winthorpe has been on the phone to his contacts in Copenhagen, trying to understand the Danish pension situation. “Darling, I don’t speak Danish, but I’m fairly certain ‘sell everything American’ sounds the same in any language.”

The Financial Nuts consensus: “Headlines say panic. Charts say bearish. There’s a difference. Percy’s desk is not actually for sale.”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

[Source: Historical gold price data comparison, January 1973 vs January 2025-2026]

Meme of the Day:

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.