Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

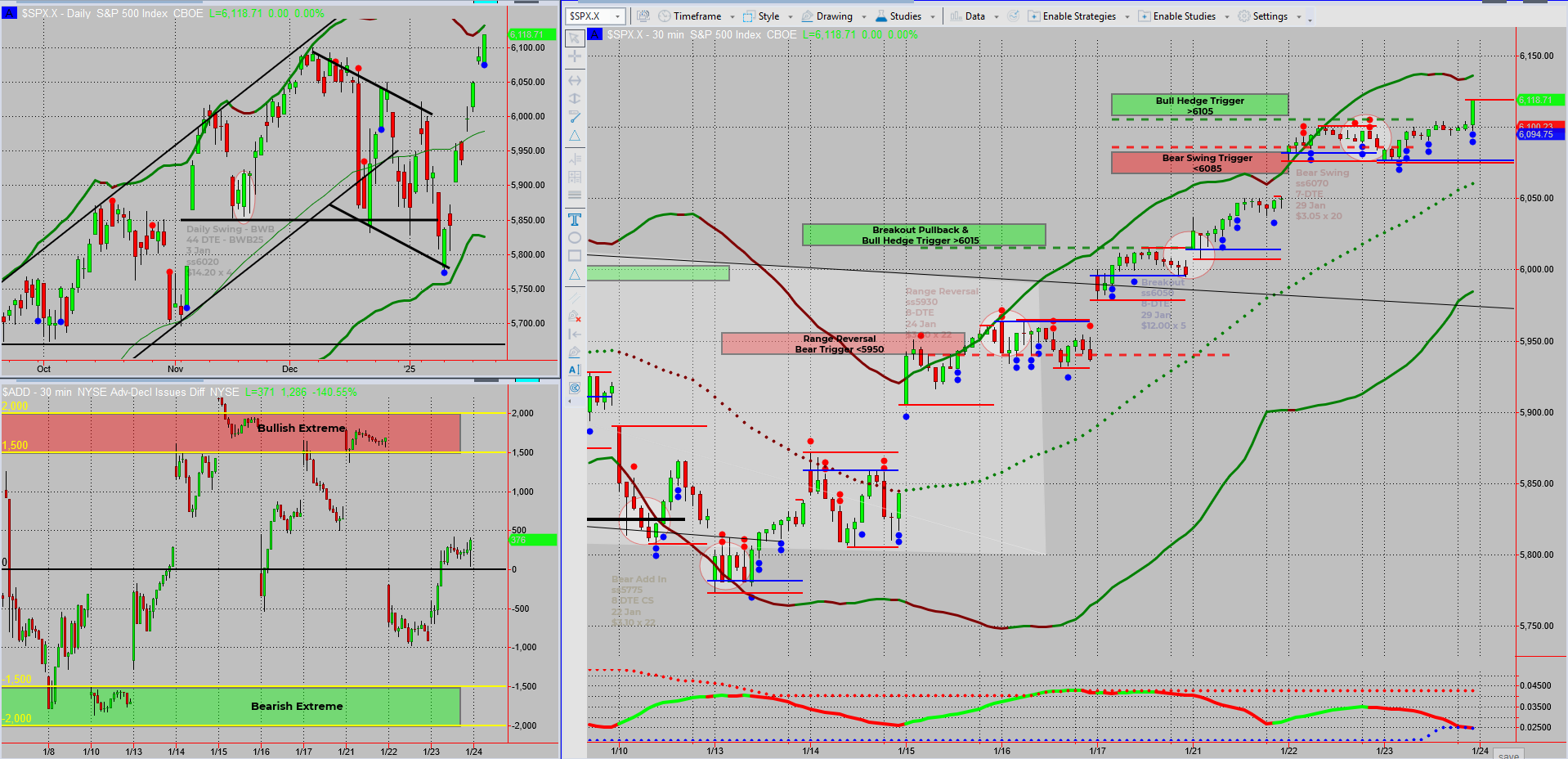

SPX continues to climb higher, defying gravity with an almost magical ascent (with a wink of exaggeration!).

While my long calls on DIA, QQQ, and IWM are doing nicely, I can’t shake the feeling that the markets need a breather.

Let’s dive into the charts and explore what’s happening beneath this seemingly unstoppable rally.

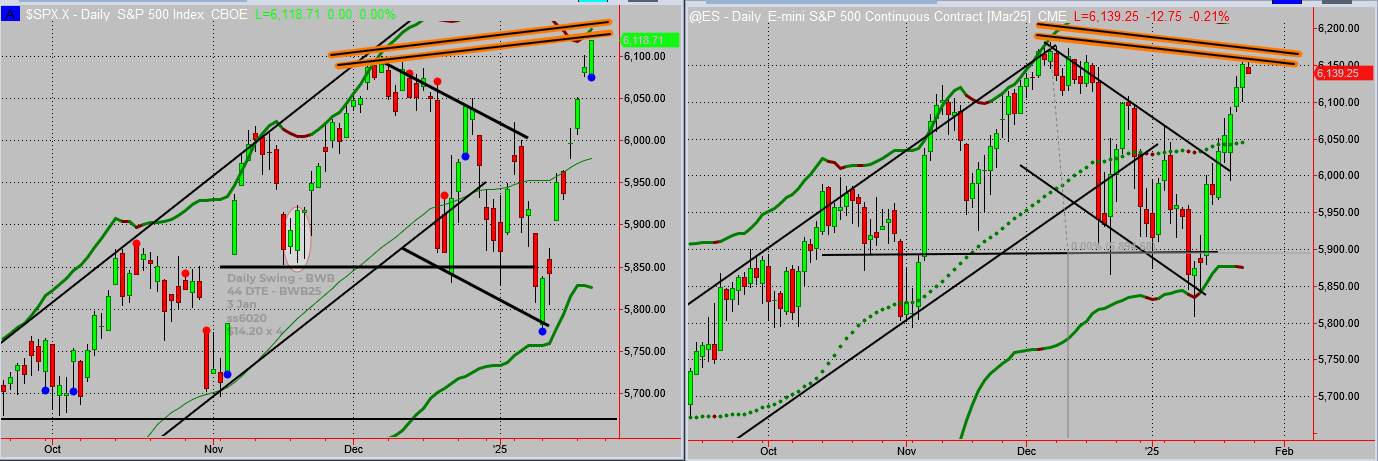

Divergence between Cash (left) and futures (right)

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Breakout Analysis:

SPX Defying Gravity – For Now

The SPX continues its near-vertical climb, pushing ever higher with barely a pause. While this is excellent for long-term positions like my DIA, QQQ, and IWM calls, I’d feel far more comfortable seeing a small corrective move. A breather allows the market to rest and set the stage for the next move, whether up or down.

Cash vs Futures: A Divergence to Watch

Take a look at today’s second chart:

- Cash Prices: On the left, cash prices are making new highs.

- Futures Prices: On the right, futures aren’t following suit, failing to hit new highs.

Futures typically lead cash prices. This divergence may hint at lower prices ahead, as we approach the March expiration for the current near-month contract. A potential red flag for traders.

Staying the Course

Despite this divergence and my slight nervousness about the straight-line move, the plan remains the same:

- Stick to the system.

- Take small wins where they present themselves.

- Stay patient for those back-to-back gains we all love.

Corrections may be unsettling, but they’re also healthy. A pullback could recharge the market, setting the stage for a stronger move in either direction.

Fun Fact

Did You Know the phrase “buy the rumour, sell the news” originated in the 18th century? It was coined to describe the sharp market moves surrounding Napoleon’s defeat at Waterloo. Traders in the know made fortunes buying ahead of the news and selling into the ensuing hype!

The phrase became famous when financier Nathan Rothschild supposedly capitalised on early news of Napoleon’s defeat in 1815. He bought up British government bonds while others panicked and sold. Once the victory became public, prices soared, making Rothschild a fortune. It’s a timeless reminder to think ahead in the markets.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece