Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

If last week felt like the market had food poisoning…

Today looks like it found a dodgy kebab behind the sofa.

Friday was chaos.

Monday’s futures? Down 200+ points and counting.

Panic? Everywhere.

Volatility? Spiking like it just heard Powell say “transitory” again.

And me?

Grinning. Swing trades firing. Targets hit. Bears eating.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX Income System – Free Training

A step-by-Step system for smart traders

From Friday Puke to Monday Profits

Let’s trace the beautiful mess:

Thursday: Fever Rising

Markets looked shaky.

Sentiment soured.

But the setup was already clear – bear flags forming, GEX levels loaded, rallies fading fast.

Friday: Puke City

Markets dropped hard.

My first bear swing target? Smashed.

Momentum didn’t just fade – it faceplanted.

By the end of the session, price was accelerating downward, with every rally attempt getting slapped.

Sunday Night: Futures Panic

As of writing, futures are down 200+ points.

Traders waking up to find their “buy-the-dip” thesis crying in the bathtub.

And me?

Looking at target 2 like a kid staring at a second helping of dessert.

Trade Gameplan: Stay Savage, Stay Structured

✔️ I remain bearish until proven otherwise

✔️ Still hunting add-ins on intraday pullbacks

✔️ Using lower timeframe pulse bars and Tag ‘n Turn setups for fast entries

✔️ Selling rallies until 5700 becomes a rumour from the past

The 4900/4850 zone could cause a bounce – maybe even a dead cat with Olympic hops.

But until that shows clear structure, I’ll treat any bounce as a selling opportunity.

Expert Insights: Don’t Flinch Into FOMO

Common Trading Mistake:

Freaking out when the market dumps and chasing long too soon out of boredom or FOMO.

Fix:

Stay with your plan.

Only switch bias if your system says so – not because Twitter is screaming “Oversold!!!”

If you’re structured, you’re profiting.

If you’re guessing, you’re the liquidity.

Fun Fact

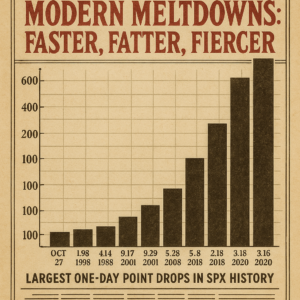

During the 2020 COVID crash, SPX dropped 113 points in a single day and everyone screamed “Unprecedented!”

Today’s futures are gapping 200+ points…

But thanks to the rise of 0-DTEs and gamma traps, modern markets puke faster than ever before.

This isn’t panic – this is accelerated digestion.

Video & Audio Podcast

️

️

No Talking Head Today

I’ve given the microphone and camera the day off.

But don’t worry – the markets are still screaming, and I’m still bearish.

Back soon with more face, more voice, and fewer filters.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% Off

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

Join today and I will personally hop on a quick start call with you to get setup and running in my system in less than 45-mins.

- Options 3: Join the Fast Forward Mentorship – 50% Off

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.