Patience Is a Position – Here’s What I’m Watching

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

The markets continue to be a lesson in patience.

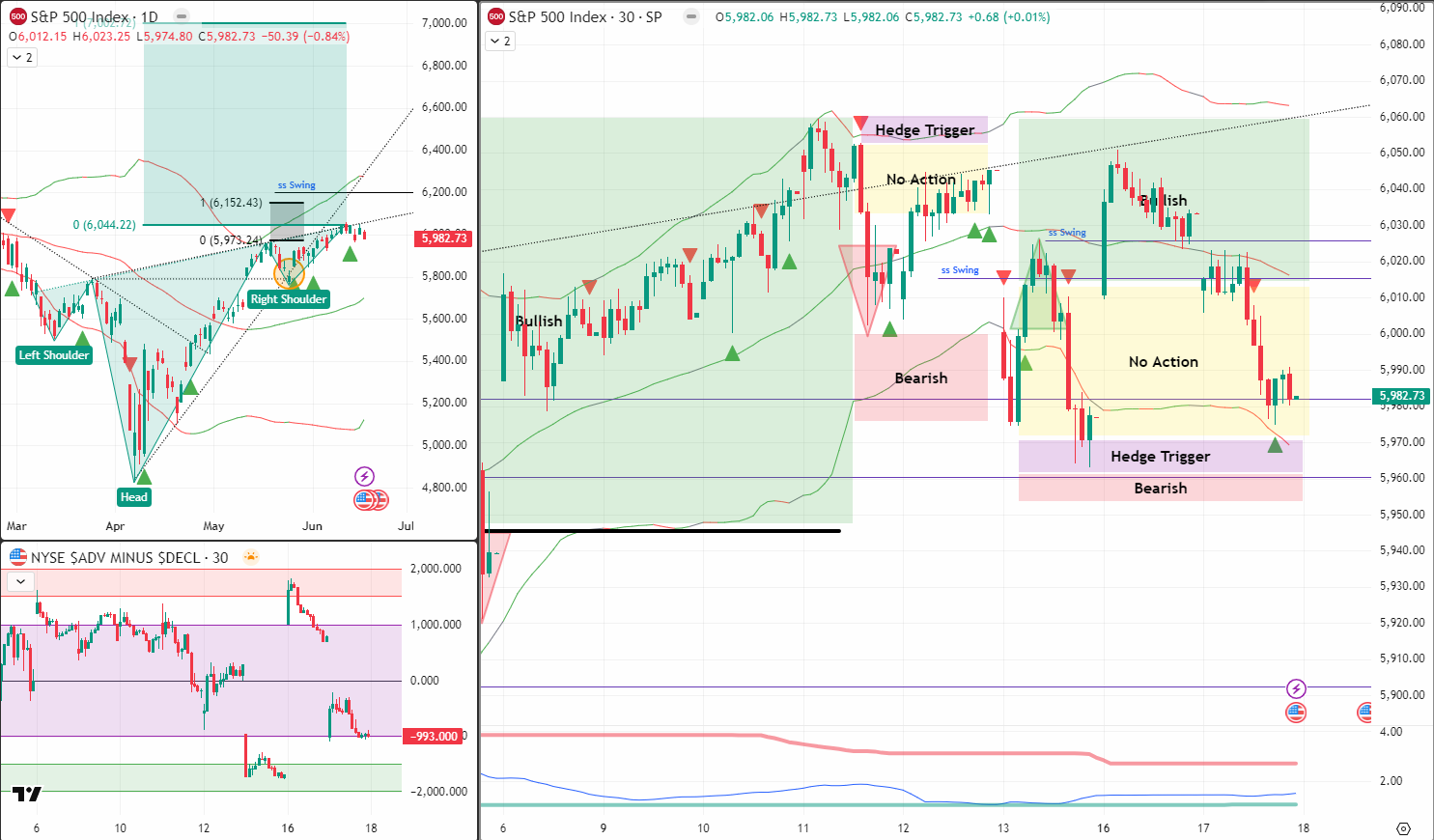

Tuesday saw price drop directly into my no-action zone.

That means exactly what it sounds like: nothing to do but sit still.

Missed the move? Don’t worry – we log receipts. Keep going.

One Chart. One Setup. Daily SPX Income Locked In.

No indicators. No guesswork. Just pulse bar profits on repeat.

SPX Market Briefing

There’s not much else to say today other than this:

- I’m still bullish.

- I’m still waiting.

- And I’m not hedging just because things look slow.

Price dropped into a zone where no trades are valid for me.

That zone? It’s the one where hope lives and edges die.

It’s where traders get twitchy, clicky, and sloppy.

Not us.

Overnight futures are up roughly 15 points – but that’s not a reason to act.

No pulse bar.

No breakout.

No urgency.

And just as importantly…

We’re approaching the lower Bollinger Band again.

What does that mean?

It means if we see a bullish setup, I’ll likely be jumping on it – not running for hedges or panic trades. In this case I do not need a new position as I already have a position but it will prevent me from needing to hedge immediately again.

Until then?

We wait.

Because the trade isn’t always a position.

Sometimes it’s the discipline to do nothing.

Expert Insights:

Hedging too early when your core setup hasn’t triggered.

What Happens:

-

Traders confuse “quiet” with “danger”

-

They hedge defensively, not strategically

-

They interrupt good bullish bias by pre-empting the chart

✅ Avoid It:

-

Let the setup prove itself

-

Wait for confirmation (e.g., pulse bar, breakout, volatility shift)

-

Don’t hedge boredom – hedge breakouts, breakdowns, or booked profit

Rumour Has It…

“Gamma Clown Fund Replaces All Risk Managers With Reddit Quotes”

After seeing zero volatility for 3 days, the Gamma Clown Fund has removed all their risk controls and replaced the dashboards with motivational memes.

Quotes now flashing on their monitors:

“Buy the dip, unless you’re scared.”

“No guts, no theta.”

“It’s only risk if you feel it.”

Insiders say they’re also testing an alert that sounds like a laugh track when traders hedge too early.

Good luck out there.

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact

SPX Bollinger Bands Mean Reversion Stats

When SPX hits the lower Bollinger Band on a 30-minute chart,

historically, it shows short-term mean-reversion behavior during consolidations.

But here’s the key:

Lower BB touches can look tempting —

but we need a trigger, not just a tag.

Setups > Speculation. Always.

Meme of the Day

“He who waits… keeps his theta.”

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.