Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

SPX Deeper Dive Analysis:

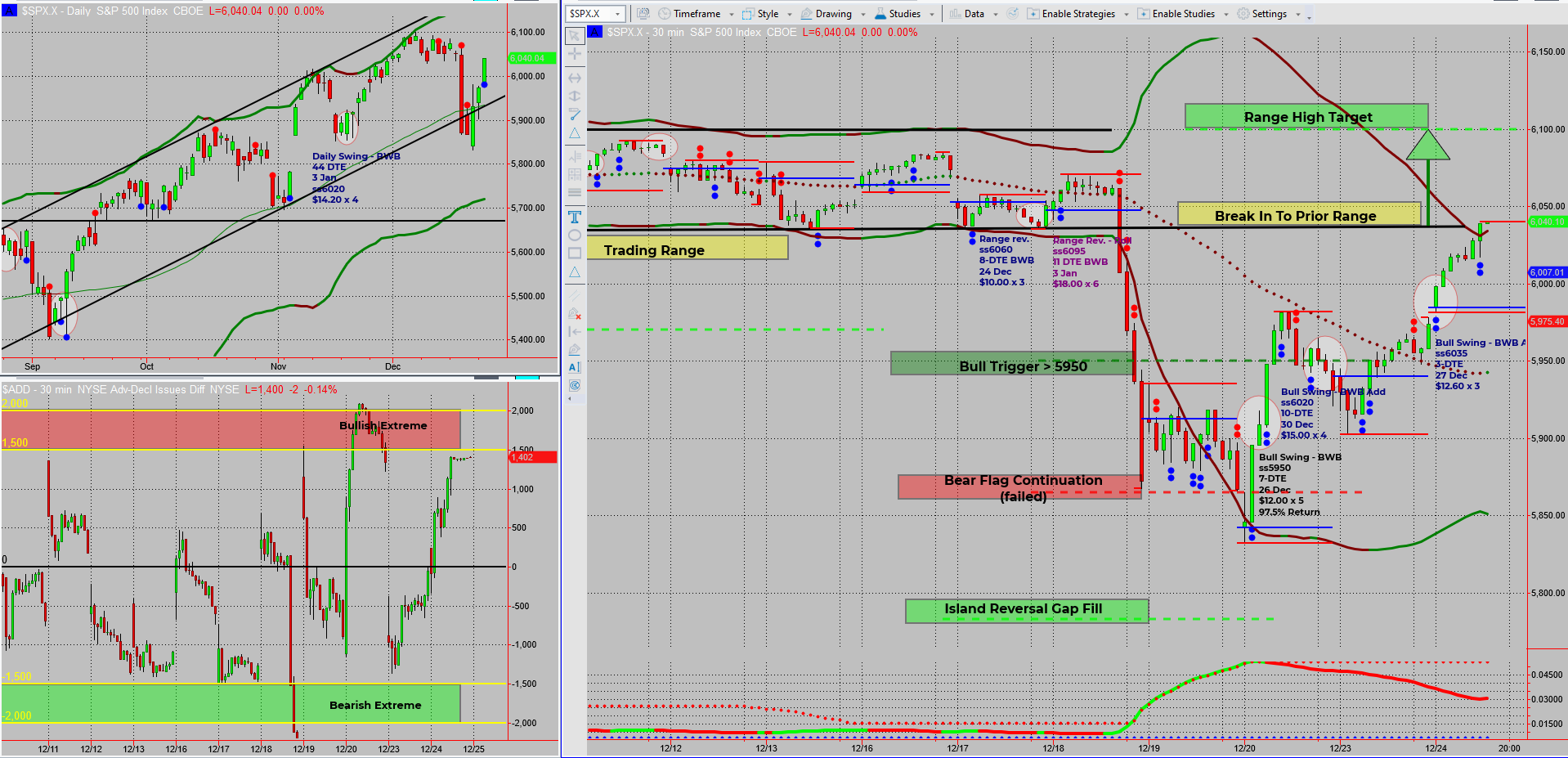

After the festivities, markets are easing back into action before the New Year pause. SPX remains bullish, creeping into a prior trading range. This brings the range target of 6100 within reach—a mere 70 points away. The talking heads might yet get their Santa Rally headlines!

- Overnight Futures: Down ~20 points. Small gap-down likely at open.

- $ADD Movement: Pullback from bullish extremes could set the stage for a rally.

- Bullish Outlook: A push toward the range high aligns with the broader trend.

Meanwhile, I’ve been busy managing trades:

- Current Positions: Profit targets are being hit across my setups.

- Prior Range Reversal: Initially went south but has been effectively rolled. Duration extended, premium collected, and recovery underway.

- Butterfly Profits: Holiday trades have delivered in a big way, proving once again the resilience of the SPX Income System.

Looking ahead, the path to 6100 seems clear, with the potential for all-time highs still on the table. For now, it’s about patience, smart trade management, and enjoying the holiday glow.

Fun Fact

The S&P 500 has closed positive in 73% of Decembers since 1928. Historically, it’s one of the strongest months for equities, driven by optimism and year-end portfolio adjustments.

While December brings joy to traders, the trend also shows that markets often rally into year-end before taking a breather in January—a perfect reminder to plan both bullish opportunities and cautious exits.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece