Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

A good trade is easy to manage—you set it, watch it play out, and collect your profits.

But what about the trades that don’t go your way immediately? That’s when most traders freeze like a rabbit in the headlights, wondering what to do next. Not me. I follow the plan.

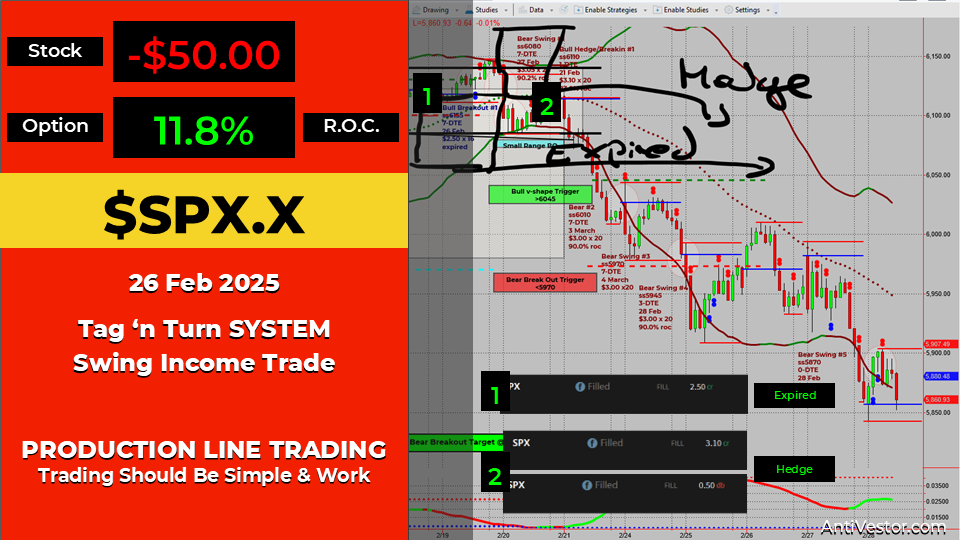

This trade was one of those puzzles—a bullish breakout that flipped bearish almost immediately. Because I had a pre-planned hedge trigger, I took action, executed the hedge trade, and ended up with an 11.8% gain, even though I was completely wrong on direction.

Let’s break it down.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

This bullish breakout trade looked solid at first—but the very next day, price stalled and turned lower, heading straight for my bear/hedge trigger.

Why Having Entry & Exit Triggers Matters

✅ Entry triggers tell me when to get in

✅ Exit/hedging triggers tell me when to take action

✅ No overthinking, no hesitation—just execution

Because I had these triggers in place before the trade even went live, I didn’t panic or hesitate when price reversed. Instead, I immediately took action when the bear trigger hit.

How the Trade Played Out

✅ Bull swing collected $2.50 per contract (16 lots)

✅ Hedge trade collected $2.60 per contract (20 lots)

✅ Hedge exited the next day, locking in profit

✅ Final result: 11.8% return despite being wrong

Interestingly, once the hedge trade was closed, the original bullish trade was technically risk-free. There was still a small chance to manage it for breakeven—but alas, the market had other ideas.

Key Takeaways:

✅ Being wrong didn’t cost me money—it made me a small profit instead

✅ Having a process prevents bad decisions under pressure

✅ Trading isn’t about being right—it’s about managing risk

A well-executed plan turns losses into small wins, and this trade proved it again.

We walk through the trades often in real time during our Fast Forward Mentoring calls – Want to join us?

Fun Fact

Did you know? In 2012, a trader at Knight Capital accidentally placed $7 billion in unintended orders in just 45 minutes, causing the firm to lose $440 million—and nearly go bankrupt—all because of a software glitch.

The Lesson? Having a plan is great. Having a system that executes it properly? Even better. Always check your risk management, because even a small mistake can turn into a very expensive lesson.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece