Santa Rally Time – Talking Heads Lose Their Collective Shit Over 1.3% Average Move

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Morning traders and I’m safely back in Blighty after some fog-fuelled delays getting out of Poland.

If you haven’t been, you should definitely put it on your list. It is one of our favourite places to visit at any time of year.

I think it’s fair to say the bear snap move ain’t gonna happen this year. I’ve held on to the hope that is now a single threadbare strand.

Keep scrolling for the truth about Santa Rally hype versus reality…

While talking heads lose their minds over seasonal effects, systematic traders just follow the process.

Market Briefing:

Current Multi-Market Status:

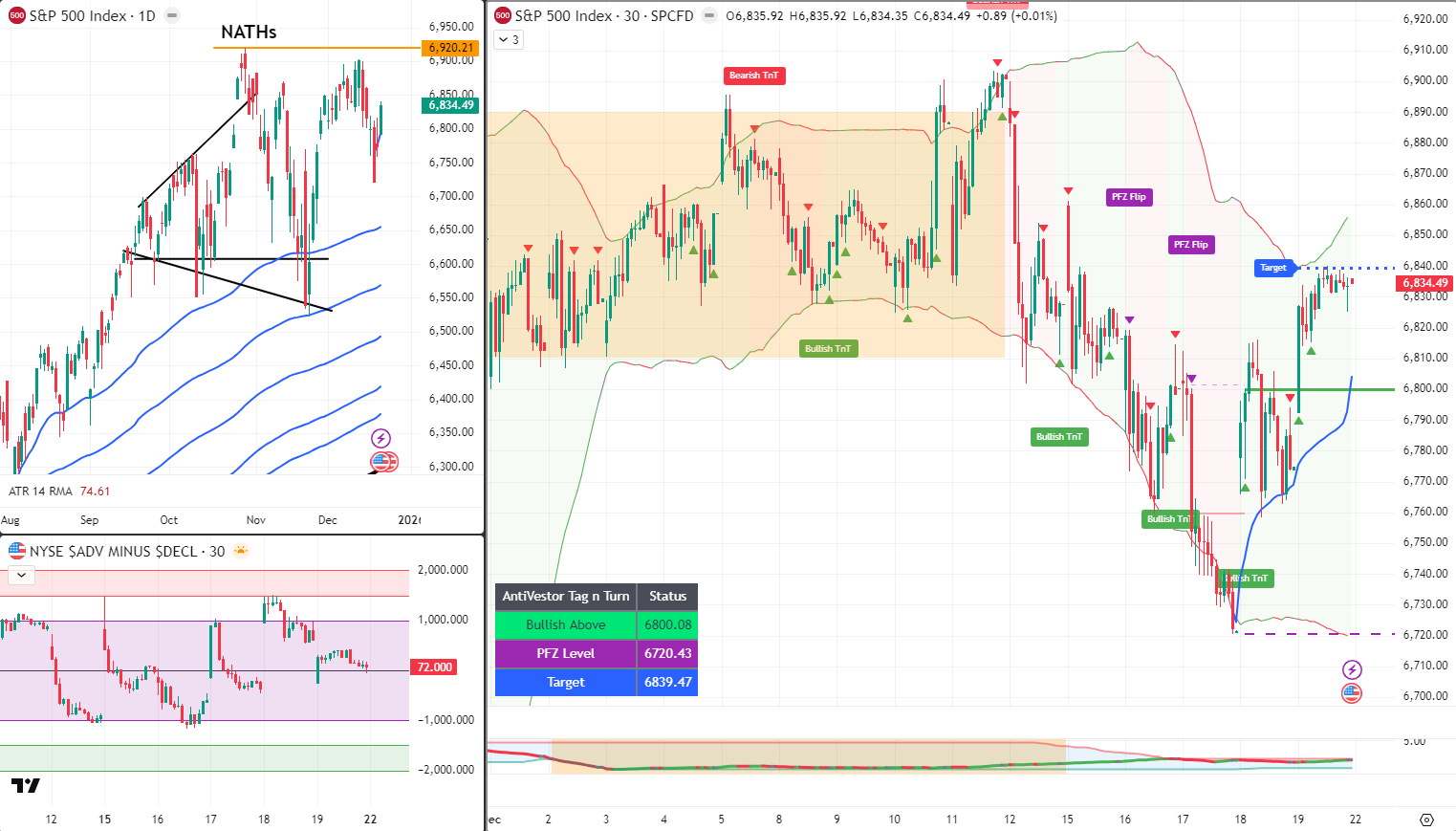

- SPX: 6,834.49 – Bull TnT – Bullish Above 6800.08, PFZ 6720.43, Target 6839.47

- RUT: 2,531.16 – Bull TnT – Bullish Above 2526.78, PFZ 2487.97, Target 2541.81

- ES: 6,910.75

- NQ: 25,714.25 (the excited Elf)

- YM: 48,506

- RTY: 2,554.4

- VIX: 15.12

- GC: 4,445.8

- CL: 57.02 / 55.12

- BTC: 93,161 / 89,582 (carnage continues)

The Santa Rally Hype Machine

It’s time for Santa Rally considerations.

Which I always find fun because the talking heads literally lose their collective shit over this annual phenomenon.

And when you look at the stats? There is only a very slight bullish movement. Over the official 5-7 days post Christmas Day and up to the 2nd-ish of January.

It’s a very small time window with a very small bullish move.

The media makes it sound like Christmas morning at the NYSE.

The Bigger Picture

For myself, I’m back at the desk proper and not trying to squint at my mobile phone.

What I can see is that fuck all has changed.

The bigger picture is that we are still near the upper area of the larger range. Where you can also see a tiny small range which has been grinding itself out on 3 of the 4 indexes.

With Naz running around like a headless chicken. Or perhaps an excited Elf shouting “IT’S CHRISTMAS!” to anyone and everyone that will listen.

SPX Tag n Turn

SPX TnT turned bull on Friday while I was in transit. So I will have to wave that one from the sidelines and look for my entry point.

Although we are very close to switching back to bearish (again) and the Bollinger Bands are quite tight together.

RUT Tag n Turn

RUT is in lockstep and bullish too. The main difference being the smoother ride down and turn without the many false starts.

The Bollinger Bands are also very tight here, highlighting the lack of price volatility.

Calendar

Unsurprisingly, there is little news on the calendar:

- Tue 23 Dec: Prelim GDP q/q 8:30am (Forecast 3.2%, Previous 3.8%)

- Wed 24 Dec: Unemployment Claims 8:30am (Forecast 220K, Previous 224K)

- Thu 25 Dec: Christmas Day

- Fri 26 Dec: Nothing

Expert Insights:

Santa Rally hype season – talking heads losing their minds over seasonal effects.

Let’s look at the actual data.

Since 1950, the S&P 500 has gained an average of just 1.3% during the Santa Claus Rally period (last 5 trading days of December, first 2 of January).

It happens about 77-79% of the time – which sounds impressive until you realise the market finishes positive on roughly 58% of ALL seven-day periods anyway. The normal seven-day average return is about 0.2-0.3%. So yes, the Santa Rally is statistically real – but it’s a 1.3% move over 7 days.

That’s not exactly “rally” territory for most traders.

Yale Hirsch, who coined the term, famously said: “If Santa Claus should fail to call, bears may come to Broad and Wall.”

The absence of the rally has historically been more significant as a warning signal than the rally itself has been as a profit opportunity.

[Source: CME Group OpenMarkets – “The History of the Santa Claus Rally”]

In Other News…

Santa Rally “Window” Opens: Markets Discover Holiday Calendar

Oracle’s TikTok deal solves nothing. Silver +140% YTD. Oil collapses to 5-year lows. BOJ hikes to 1995 levels. “Window” for gains.

Tech rebounded into holiday week as “Santa Rally window approaches”—markets discovering calendar event guarantees gains through mysterious mechanism. Oracle surged 6.5% Friday on TikTok joint venture agreement proving regulatory arbitrage beats actual business model. Precious metals dominated year: gold +65% YTD at $4,340, silver record $69 (+140% YTD), platinum $1,980 (highest since 2008) whilst oil collapsed to $56 near 5-year lows creating commodity divergence nobody explaining.

When Holiday Calendar = Investment Thesis

Markets pricing “Santa Rally window” as Christmas-shortened week approaches—trading tradition where low volume and hope combine into strategy. Consumer sentiment 52.9 missed 53.5 expected but improved from November’s 51.0 proving less terrible counts as bullish. Bank of Japan hiked to 0.75% (highest since 1995) whilst Fed pauses creating central bank divergence where everyone tightening and easing simultaneously.

Oracle’s TikTok Deal: Regulatory Theater

Oracle +6.5% on TikTok joint venture that solves precisely zero actual problems—political solution masquerading as business deal. Nvidia gained on H200 China sales “optimism” despite regulatory review uncertainty proving maybe selling sometimes beats definitely not selling. AI trade attempting recovery after December spending concerns because apparently one good Friday erases month’s worth of doubt.

⚖️ Precious Metals Soar, Oil Collapses: Pick One

Gold +65% YTD, silver +140% hitting records, platinum at 2008 highs whilst oil plunges to $56 (-20% YTD, near 5-year lows) creating commodities choosing completely opposite directions. Dollar at 8-week low supporting metals, destroying energy. Markets treating this divergence as normal rather than questioning which signal correct.

☕ Hazel’s Take

Santa Rally “window,” Oracle’s regulatory arbitrage, silver +140% vs oil -20%, BOJ hiking to 1995 levels. When holiday calendar = thesis and TikTok joint venture = solved, probably acknowledging Christmas week low-volume hope beats year-end reality.

—Hazel, FinNuts

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was spotted training his pigeons in “Fog Delay Navigation Protocols” whilst explaining that the bear snap move required “Single Threadbare Strand Hope Assessment with Santa Rally Statistical Debunking.”

Hazel immediately updated her crisis flowcharts to include “Talking Head Collective Shit-Losing Response Procedures” alongside “1.3% Average Move Reality Check Contingencies.”

Mac raised his morning whisky and declared, “When the entire financial media loses their minds over a 1.3% move, the proper response is obviously to pour another dram and follow the process!”

Kash attempted to explain that “the Santa Rally is basically like a meme coin pump but with better marketing and worse returns” before getting distracted by Nasdaq’s Elf-like behaviour.

Wallie grumbled that in his day, “we didn’t need fancy names for small seasonal moves – we just called it ‘the market doing market things’ and got on with it!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

Santa Rally: The Most Overhyped 1.3% In Finance

Average Santa Rally return since 1950: 1.3% over 7 days. Average ANY 7-day period: 0.2%. The hype-to-reality ratio is approximately infinite.

Every December, without fail, the financial media transforms into the marketing department for Christmas itself. “SANTA RALLY INCOMING!” they scream, as if St. Nick himself is about to airdrop tendies into your brokerage account.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.