Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

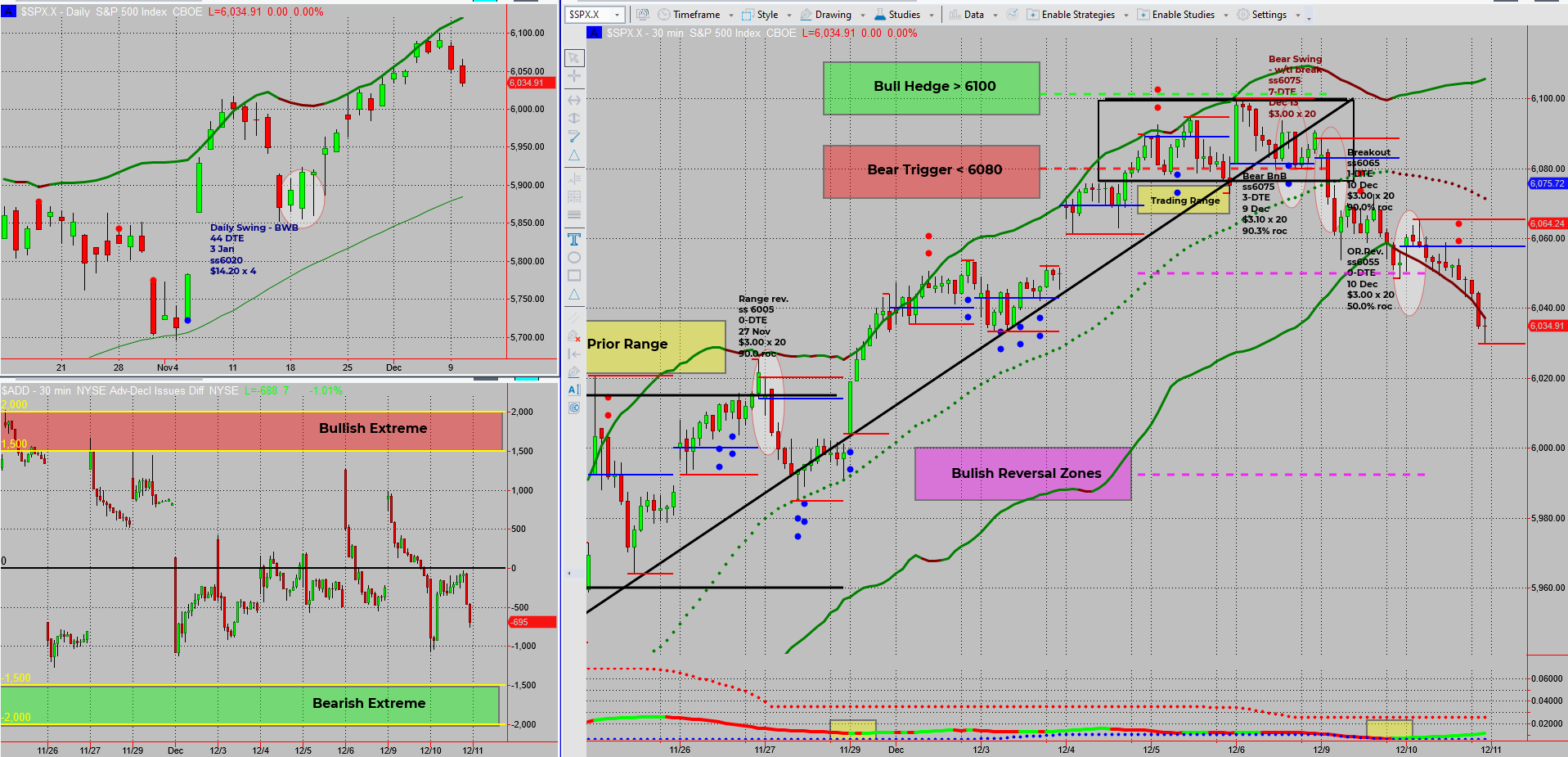

SPX markets are dancing to the anticipated tune, pushing lower and rewarding bearish trades! Three “SPX Income System” setups hit profit this week, with a potential dip to $6000 on the horizon. Let’s break it all down and uncover what’s next!

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

The market has been unfolding exactly as anticipated, with the SPX delivering profits from three bearish setups this week. These trades capitalized on the gradual move toward the $6050 level, a key zone we’ve been watching closely.

Now, with price pushing below $6050, the stage is set for a potential move down to the $6000-$6020 range. This prior consolidation zone could serve as an excellent area to evaluate bullish swing opportunities.

$ADD remains middling around the +/-1000 level, but a further price dip should push it into a bearish extreme. This could act as the signal to start preparing for bullish pulse bar entries, aligning perfectly with the SPX Income System’s rules.

For now, I’m holding bearish income swings, which continue to deliver steady profits, while waiting for confirmation of a bullish reversal. As always, the market rewards patience and preparation, and I’m ready to strike when the next opportunity presents itself.

- What’s Next?

- Price broke below $6050, targeting $6000-$6020.

- This consolidation area could host the next bullish swing.

- Indicators at Play

- $ADD remains near the neutral +/-1000 zone.

- A bearish extreme in $ADD would confirm bullish pulse bar setups.

For now, bearish income swings are reaping the rewards. The focus is on capturing profits while keeping an eye out for bullish reversal opportunities when conditions align.

Fun Fact:

SPX’s Record-Breaking Streak:

Did you know that in 2017, the S&P 500 went 310 trading days without a 3% decline? That’s the longest streak since the 1920s, showcasing its resilience in bullish times.

This remarkable streak highlights the index’s stability during bull markets. It reflects how investor confidence and economic optimism can create sustained uptrends, even amidst occasional volatility.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece