Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

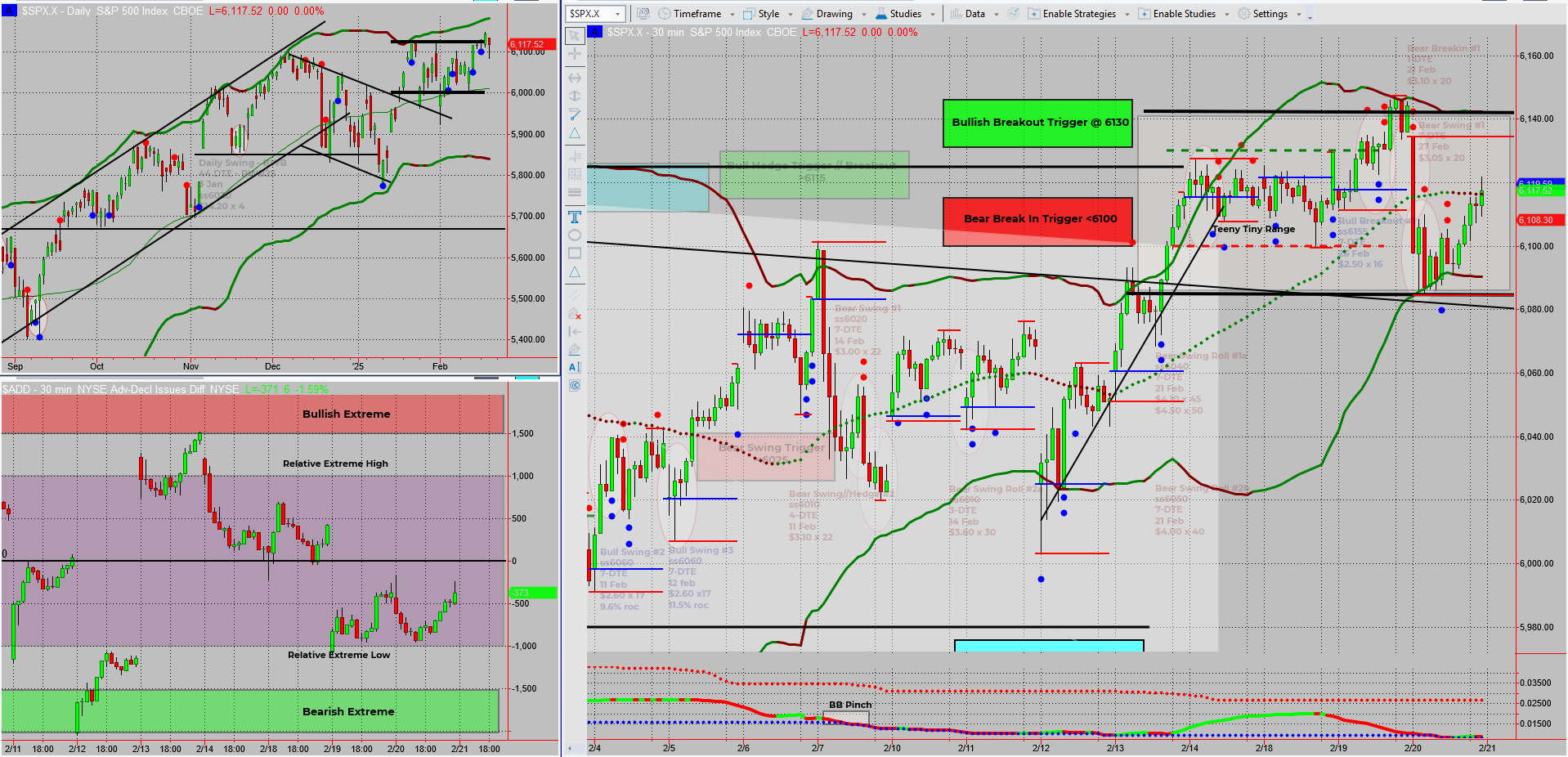

These kangaroo markets just won’t quit. Every time we break out of one range, the Bollinger Bands pinch again, locking us into another one.

Meanwhile, other indexes fell out of bed, but SPX? It’s clinging on by “the Bulls”.

When will it finally open up and run? Who knows—but until then, I’ll keep finding new ways to say ‘hurry up and wait’.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

$500-$5,000+ Days – Even in a Market Collapse!

Important Question: What if you could turn market uncertainty into a $500-$5,000+ daily opportunity – in just minutes?

Imagine logging in, placing a simple trade, and moving on with your day – stress-free.

The SPX Income System has helped traders generate consistent, recession-proof income – WITHOUT needing years of experience.

Now It’s your turn – Click watch free training and start trading smarter today!

SPX Deeper Dive Analysis:

Markets Keep Bouncing, But Not Breaking

It’s like watching a kangaroo on a trampoline—lots of movement, no real progress.

- SPX tries to push out of one range ️♂️

- Bollinger Bands pinch again, trapping price in a new range

- Other indexes have fallen, but SPX refuses to follow

This makes trading tricky, as every potential breakout is quickly absorbed into another consolidation.

The Bollinger Band Pinch – What It Means

When Bollinger Bands tighten, they signal:

A period of low volatility

A potential breakout coming – but direction unknown

Traders getting frustrated waiting for a real move

Normally, I’d switch to Tag ‘n Turn setups during breakouts, but with volatility still tight, I’ll stick to my 6 money-making patterns instead.

For now, it’s all about waiting for a clean break—no fake moves, no forced trades.

Final Thoughts – When Will the Market Open Up?

The big move is coming—we just don’t know when.

SPX is clinging on, but other indexes are weakening—watch for cracks.

Bollinger Bands are tightening—when they expand, volatility will return.

Until then? It’s back to ‘hurry up and wait’.

Fun Fact

Did you know? In 2015, the New York Stock Exchange halted trading for nearly four hours—and the official reason? A “technical glitch”.

The Lesson? Even the biggest, most advanced markets can freeze up, just like we’re seeing with these tight, choppy conditions.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece

Edit – PostScript – just before the open

Normally, the major indexes have a habit of moving together, but today? It’s every index for itself.

- Dow is down -0.6%—classic risk-off move

- Russell 2000 is up +0.4%—small caps showing strength

- Nasdaq is up +0.3%—big tech trying to hold ground

- SPX? Well… it’s doing its best impression of a houseplant.

Why Divergent Markets Matter

When markets move in different directions, it usually means:

- Traders are confused—uncertainty is high

- Volatility is brewing—one side is about to be very wrong

- A major shift could be coming—but which way?What’s the Pressure Point?

- If the Russell and Nasdaq hold strength, they could pull the Dow and SPX up with them

- A broad market recovery could follow, leading to another breakout attempt

- If the Dow’s weakness spreads, it could drag the rest of the market down

- SPX, currently asleep, could wake up and join the drop

For now, I’m watching for the trigger—when these mixed signals finally resolve into a clear move.Final Thoughts – What’s Next?

- SPX is the key—if it moves, the rest will likely follow

- Watch for sudden volume spikes—that’s often the first sign of a decisive move

- Patience wins the game—don’t jump in too early, let the market tip its hand

Until then? Grab some popcorn, because this one could get wild.