Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

What if I told you that being wrong doesn’t mean losing money? That’s exactly what happened this week, and it’s a perfect example of why the SPX Income System works—even in a sideways, messy market.

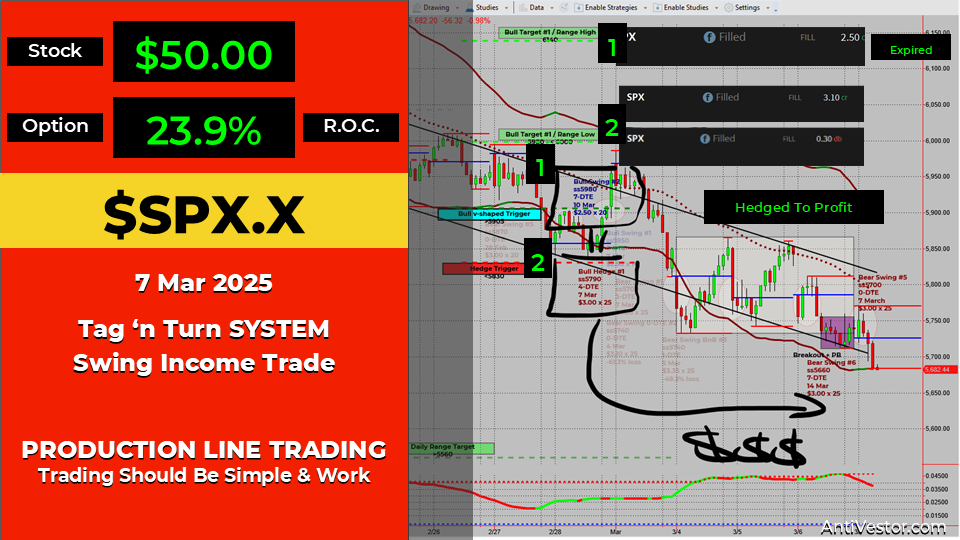

On Friday, 28th Feb, the Tag ‘n Turn setup triggered a bullish entry. Then, on Monday, 3rd March, the bullish hedge trigger was breached, flipping the trade dynamics. Both levels were discussed live in our Fast Forward Group calls & SPX blog analysis.

- ✅ Bullish trade collected $2.50 (16 lots) – expiring for a loss

- ✅ Bearish hedge collected $3.00 (25 lots) – bought back for $0.30

- ✅ Final result: A 23.9% gain, despite a choppy market

It’s another textbook case of how managing risk and hedging properly can turn losses into wins. The bullish add-in & hedge are closing out soon, so I’ll update as it unfolds.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

Consistent Daily Income from the Stock Market – Without Guesswork!

Discover the SPX Income System – a proven, 100% rule-based trading method that lets you collect daily and weekly income checks in just minutes per day.

No trend chasing. No chart-watching all day. Just results.

Now It’s your turn – Click watch free training and start trading smarter today!

Deeper Dive Analysis:

Trading is often about adapting to the market, not forcing it to do what we want. This week’s messy price action proved why having a system that accounts for uncertainty is crucial.

The Tag ‘n Turn setup gave us a clear bullish entry on Friday, 28th Feb, and by Monday, 3rd March, price action breached the bullish hedge trigger. Both of these levels were highlighted in real time on our Fast Forward Group calls and daily SPX analysis blog.

What happened next is exactly why the SPX Income System is different from traditional trading.

- The bullish trade collected $2.50 on 16 lots, but it’s going to expire for a loss. This would be a disaster for most traders, but not here.

- The bearish hedge trade, which collected $3.00 on 25 lots, was bought back for just $0.30, flipping the entire trade outcome.

- Despite sideways, sluggish market conditions, the trade ended with a net 23.9% gain.

A small win in an otherwise frustrating week, but a win nonetheless.

And here’s the key takeaway: I didn’t have to be right. The system allowed me to profit despite the original trade setup not working. Hedging & proper risk management made all the difference, something that most traders overlook in their strategies.

The bullish add-in & hedge are currently working through a similar exit process, and I’ll provide updates once those close. But for now, another week, another profitable outcome—despite the market’s best efforts to ruin the party.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece