Narrative Noise vs. System Clarity

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

It’s always entertaining to see how after-the-fact analysis gets twisted into a narrative.

Thursday’s headlines had it all:

Trump vs Powell – again.

Tariff rumours whiplashing sentiment.

Flat Dow, mild SPX/Nasdaq gains… so, was it bullish?

Not quite.

See, while the news machine scrambled for reasons, price was already voting. And we were watching.

Pre-market looked hopeful for the bulls. But by the end of the opening rotation, it was crystal:

More downside potential, less upside conviction.

5400? Rejected.

Pulse bar? Absent.

But that beautiful v-shaped pivot? Picture perfect.

So, we leaned in. Flipped bias. Took the trade. Reviewed it later in the blog.

And as the great Gann said – always be ready to change your mind (especially when the market changes its tone).

Let’s break it down.

⬇️⬇️⬇️ – keep scrolling for more in-depth analysis – ⬇️⬇️⬇️

SPX. 30 Minutes. One Trade. Job Done.

Trade less. Profit more. This isn’t trading… it’s income engineering.

SPX Market Outlook – Structure Rejected, Futures Rolling

While the headlines continue to spin post-news confusion, the price action remains our guide.

Yesterday, we came into the session prepared for a bullish continuation, but 5400 acted as a firm barrier once again.

The daily chart showed a clear rejection, and despite the bullish lean in the morning, the structure leaned bearish by session’s end.

Now, as I write this before the cash open, overnight futures are pushing lower, indicating potential follow-through.

That doesn’t confirm anything just yet – but it does tilt the bias.

Here’s what I’m watching:

-

5400 = still key resistance

-

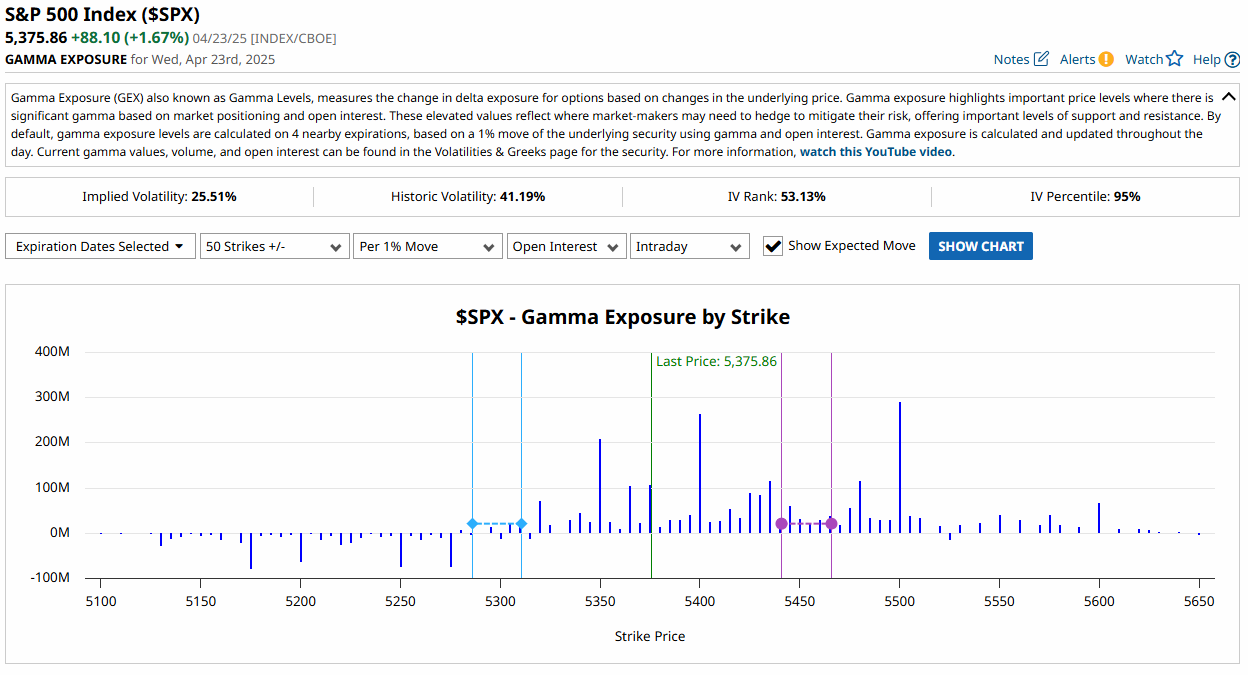

5300 = GEX flip level – will reassess bearish view if we break and hold below it

-

5000 remains the target for the Wolfe pattern continuation

-

Upper Bollinger tag is in – another technical sign of short-term exhaustion

-

No bear pulse bar yet, but a clean V-shaped reversal is visible on the chart

-

ADD remains near bull extreme – offering more bear potential than bull in the short term

Bias remains bearish below 5300, and I’ll reassess to add in below that level.

GEX Analysis Update

- 5500 – 5400 – 5350 all look interesting levels

- 5300 is the current flip point

Expert Insights: Gann’s Golden Reminder

“Always be prepared to change your mind.” – W.D. Gann (kinda’)

The real skill isn’t predicting the market.

It’s knowing when the evidence has changed – and acting fast.

This is the essence of rule-based trading. No emotion. No debate.

Just: signal → action → review → repeat.

Traders lose when they hold onto the shoulds instead of reacting to the happening.

If your system flips bias mid-session – good. That means it works.

Rumour Has It… (100% satire)

-

Trump was overheard saying, “Maybe Powell’s alright. Maybe.” Dow gained 0.3% and then shrugged.

-

5400 is reportedly suing for emotional damages after being rejected for the third time this month.

-

A Wolfe Wave ghost briefly appeared on the chart, waved, and vanished near 5300.

(This section is entirely made-up satire. Probably.)

Fun Fact – News Always Arrives After Price

Markets don’t wait for clarity.

They move first, then the headlines scramble to explain why.

The pattern is timeless:

-

Price shifts.

-

Smart traders react.

-

Media catches up.

-

Retail says, “Oh, THAT’S why.”

Yesterday was no exception.

So if the news says “flat and uncertain,” but the chart shows a failed breakout, don’t wait for a CNBC blessing to press the button.

The system already said what it needed to say.

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.