Perfect 8-for-8 Execution Whilst Having Dinner With Mrs N and Monster-in-Law

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Well, the day turned out quite nice again, and we got many of them live again on the Fast Forward Insiders Calls.

Another 8-for-8 perfect execution day. This is becoming a rather enjoyable habit.

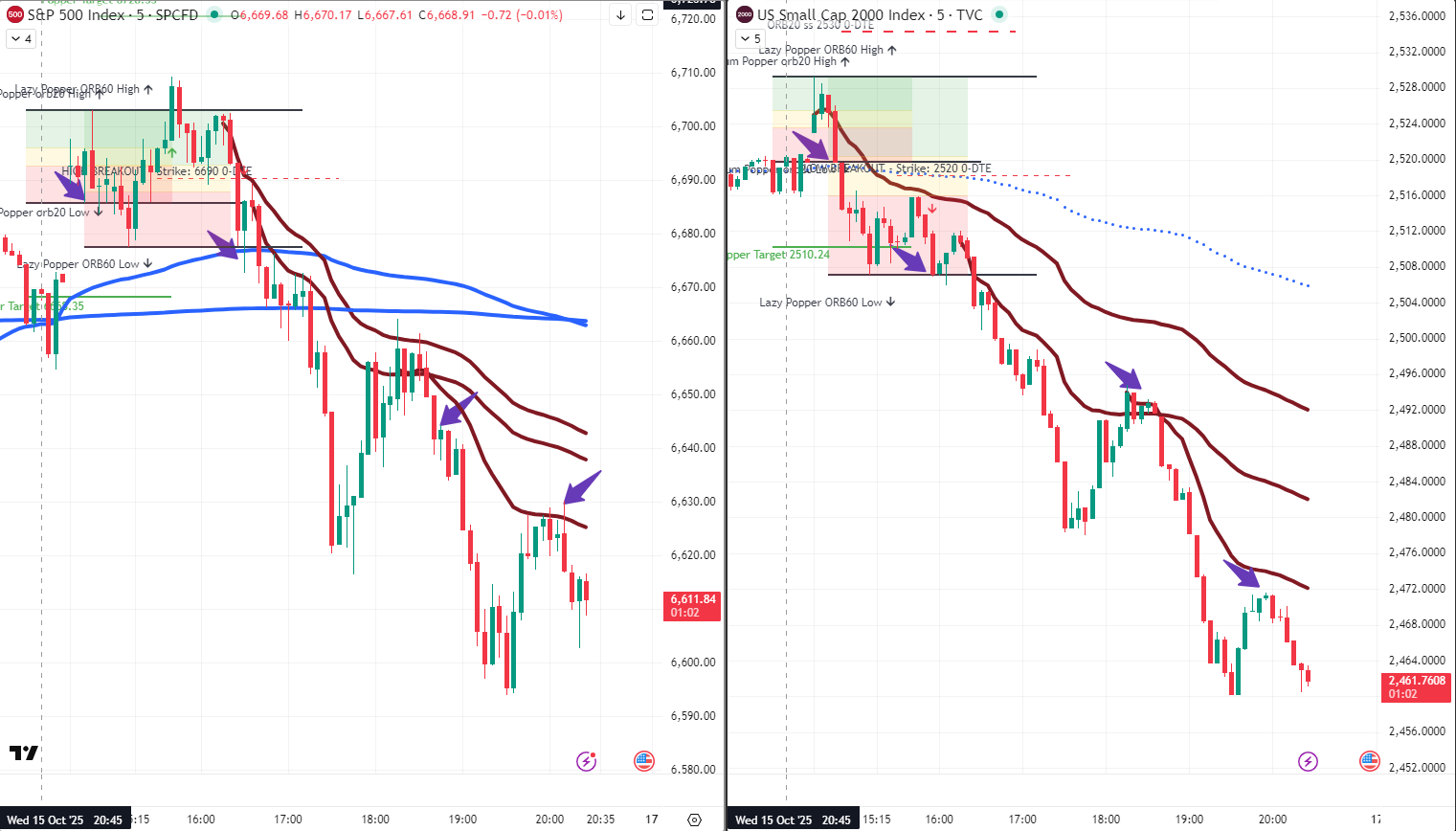

The trade entries were all around the same time on both SPX and RUT.

RUT was a lot clearer and cleaner to read compared to SPX, which has been very noisy and spikey throughout the session.

But here’s where options as a trading vehicle prove their systematic advantage:

Whilst other traders were getting whipsawed by false breakouts and noise, the options positioning held fast through the chaos.

Let me break down how living life with family whilst banking consecutive perfect execution actually works in practice.

Keep scrolling for the dessert-interrupted trade breakdown…

Eight Setups. Eight Executions. Dessert Before Profits.

Premium Popper Debrief:

Thursday brought another perfect 8-for-8 Popper execution day whilst Fast Forward Insiders watched live and I enjoyed evening meal with Mrs N and the monster-in-law.

Session Results:

- Total Trades: 8 Premium Popper setups (4 SPX, 4 RUT)

- Winners: 8 (100% win rate for second consecutive session)

- ROC Range: 50% to 58.3%

- Instruments: SPX and RUT 0-DTE options

- Timeframe: US morning session (UK evening)

- Audience: Fast Forward Group students watching live execution

- Interruptions: Evening meal with family, dessert considerations, office desk checks

The RUT Clarity vs SPX Noise Theme

Trade entries were all executed around the same time on both SPX and RUT, but the reading clarity differed dramatically.

RUT: Crystal clear, clean price action, simple to read

SPX: Very noisy, spikey, messy behaviour throughout

This is why monitoring multiple instruments matters. When one creates confusion, the other often provides systematic clarity. Both delivered perfect execution, but RUT made it significantly easier.

Trade #1: Classic 1st Breakout (Options Win vs Whipsaw Hell)

SPX Setup: Classic 1st breakout of opening range

RUT Setup: Classic 1st breakout of opening range

SPX Result: 56.5% ROC

RUT Result: 58.3% ROC (highest of the day)

Given that we use options as the vehicle to trade with non-standard stop-loss approaches, whilst many other traders were looking at whipsaws and false breakouts getting stopped out repeatedly, the trade held fast and eventually came good for profit.

RUT was simple: In and out in a few minutes with clean execution.

SPX was messier: Noise, spikes, whipsaws creating chaos for stock and futures traders using traditional stops. Options positioning doesn’t care – the risk profile holds through temporary adverse movement without triggering premature exits.

This is the systematic advantage of options over stocks/futures for these setups. Entry timing becomes less critical when your risk management doesn’t rely on price-based stops that whipsaw action destroys.

Trade #2: The “3rd Breakout” (Needs Better Name)

SPX Setup: What we call the “3rd breakout” – I’ll need a better name LOL

RUT Setup: Same “3rd breakout” pattern

SPX Result: 52.8% ROC

RUT Result: 56.5% ROC

This is where SPX got clearer and cleaner compared to Trade #1’s chaos. RUT went again to a fast exit with its usual efficiency, whilst SPX dithered before it dallied to an exit.

The “3rd Breakout” terminology needs work. It’s accurate from a pattern recognition perspective but sounds ridiculous when explaining setups to students. Mental note: Develop better nomenclature before this becomes permanently awkward.

Despite naming confusion, the setup delivered consistent 52-56% ROCs across both instruments. Sometimes terrible names produce excellent profits.

Trade #3: AVWAP Trend Setup (Dessert-Interrupted Execution)

SPX Setup: Meeting trending conditions, switch to AVWAP, sell rallies in downtrend

RUT Setup: Same AVWAP trend sell rally pattern

SPX Result: 51.9% ROC

RUT Result: 54.9% ROC

I was a little late on my entry for both of these as I was enjoying my evening meal with Mrs N and the monster-in-law.

Took a sneaky look before dessert. Time zone context: I’m in the UK, so I’m 5 hours ahead of the US. Their lunch-ish timing is my evening-ish meal.

Pop those trades on. Pop the phone back in the pocket. Pop that cake in the gap!

This is systematic trading lifestyle in practice: Family dinner doesn’t get interrupted by constant market monitoring. Sneaky phone check before dessert identifies systematic setups. Trades get executed. Phone disappears. Cake gets enjoyed. Profits arrive whilst eating.

The slightly delayed entry didn’t matter because options positioning provides flexibility that stocks and futures don’t offer. Risk profile remained identical despite “sloppy” timing.

Trade #4: Bonus AVWAP (Wasn’t Even Planning This)

SPX Setup: AVWAP trend setup appeared whilst checking desk

RUT Setup: Same AVWAP trend pattern

SPX Result: 52.4% ROC

RUT Result: 50.0% ROC (lowest of day but still excellent)

This was a cheeky little bonus trade. I was just checking something at the desk in the office and not really planning to do anything, but the AVWAP trend setup was right there presenting itself.

Pop it on. Few minutes later, popped it off again.

Cheeky!

When systematic setups appear whilst you’re doing other things, frameworks permit opportunistic execution without requiring constant surveillance. The setup either exists or it doesn’t. No emotional attachment to forcing trades.

The Options vs Stocks/Futures Advantage

All in all, another great day following the process, and even with sloppy entry timing, using options means it’s less important compared to stocks or futures.

The risk profile is exactly the same regardless of entry precision.

This is crucial for understanding why these Popper setups work so consistently:

Stocks/Futures: Require precise entry timing. Whipsaws trigger stops. Late entries create larger risk exposure. Every tick matters immediately.

Options (0-DTE): Non-standard risk management. Whipsaws don’t trigger premature exits. Late entries maintain identical risk profile. Time decay works in your favour.

When SPX was noisy and spikey during Trade #1, stock traders got whipsawed repeatedly. Futures traders hit stops multiple times. Options traders? Held through the chaos and collected profit when price eventually followed through.

This isn’t luck. This is strategic instrument selection matching setup characteristics.

The Results Summary

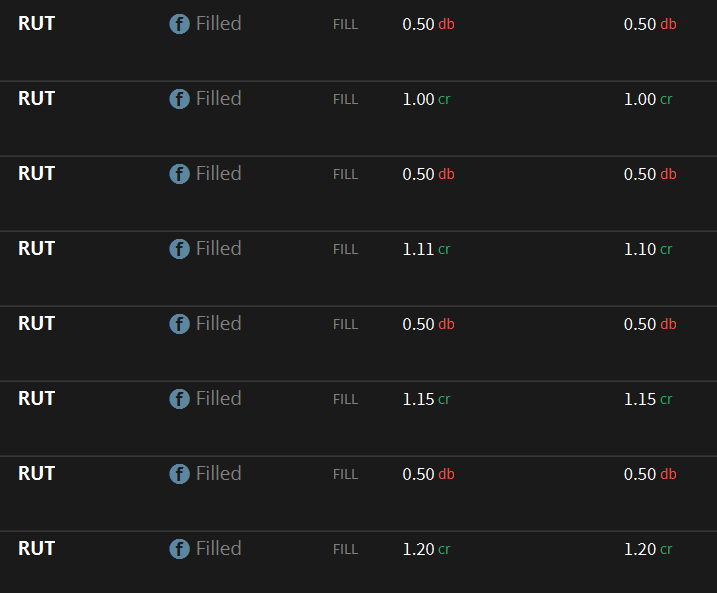

RUT Trades (Crystal Clear Execution):

- 58.3% ROC – 1st Breakout (highest of day)

- 56.5% ROC – “3rd Breakout” (terrible name, excellent profit)

- 54.9% ROC – AVWAP Trend #1 (dessert-interrupted entry)

- 50.0% ROC – AVWAP Trend #2 (bonus cheeky trade)

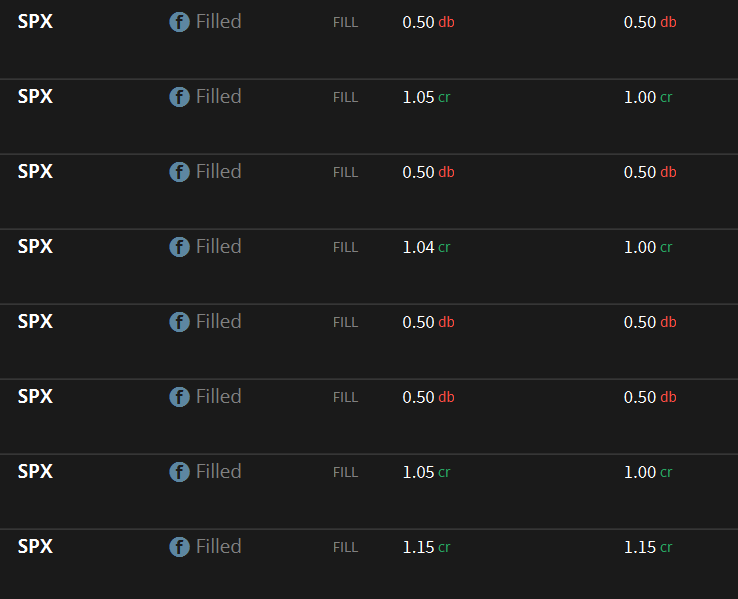

SPX Trades (Noisy But Profitable):

- 56.5% ROC – 1st Breakout (whipsaw chaos survived)

- 52.8% ROC – “3rd Breakout” (dithered then dallied to exit)

- 51.9% ROC – AVWAP Trend #1 (sneaky phone check before dessert)

- 52.4% ROC – AVWAP Trend #2 (wasn’t even planning this)

Combined Performance: 8 wins from 8 executions with Fast Forward Group students watching live whilst trader enjoyed family dinner, sneaky dessert checks, and opportunistic office visits.

Lessons From Consecutive Perfect Sessions

Yesterday: 5-for-5 perfection during mentor sessions

Today: 8-for-8 flawless execution during family dinner

Combined: 13 consecutive Popper wins across two days

1. Options beat whipsaws systematically: Non-standard risk management holds through noise that destroys stock/futures stop-losses

2. RUT clarity consistently superior: When SPX gets messy, RUT provides clean systematic signals across identical setups

3. Entry timing less critical with options: “Sloppy” entries maintain identical risk profiles – dessert-interrupted execution still delivers 50%+ ROCs

4. Life doesn’t stop for trading: Evening meals with family, sneaky phone checks, dessert considerations, opportunistic office visits all compatible with systematic execution

5. Terrible names produce excellent profits: “3rd Breakout” sounds ridiculous but delivers 52-56% consistently (still needs better nomenclature)

6. Fast Forward education through live observation: Students watching consecutive perfect execution sessions validates frameworks functioning exactly as designed

7. Systematic consistency compounds: 13 consecutive wins isn’t luck – it’s probability mathematics delivering through mechanical framework adherence

Today’s Systematic Execution:

- Trade Timing: All entries around same timeframes across SPX/RUT

- RUT Behaviour: Crystal clear, clean price action throughout

- SPX Behaviour: Noisy, spikey, messy but still profitable

- Options Advantage: Held through whipsaws that stopped out stock/futures traders

- Life Integration: Evening meal with Mrs N and monster-in-law didn’t interrupt systematic execution

- Dessert Protocol: Sneaky phone check before cake delivered two AVWAP winners

- Cheeky Bonus: Opportunistic desk check added fourth winning trade

- Fast Forward Value: Students watched live systematic delivery for second consecutive session

- Nomenclature Issue: “3rd Breakout” terminology needs improvement despite excellent profits

Rumour Has It…

Breaking from the Financial Nuts newsroom: Percy was discovered teaching his desk pigeons “Dessert-Interrupted AVWAP Formation Flying” whilst claiming they had mastered “Systematic Eight-for-Eight Premium Popper Execution During Evening Meal With Monster-in-Law Advanced Cooing.”

Hazel updated her crisis management protocols to include “RUT Clarity Beating SPX Noise Assessment Procedures” alongside emergency plans for “Sneaky Phone Check Before Cake Options Entry Integration Processes.”

Mac raised his Thursday evening whisky and declared, “When options positioning holds through whipsaws whilst trader enjoys family dinner with dessert interruptions, systematic frameworks prove themselves delightfully compatible with actual life enjoyment!”

Kash attempted livestreaming about “non-standard options risk management being basically like DeFi liquidity pool stop-loss immunity but with actual whipsaw survival through false breakout chaos” but got distracted trying to rename the “3rd Breakout” pattern to something less ridiculous.

Wallie grumbled that in his day, perfect execution required “constant market surveillance without family dinner distractions, not this modern systematic independence nonsense with sneaky dessert phone checks and cheeky bonus office trades!”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.