Ahoy there Trader! ⚓️

Ahoy there Trader! ⚓️

It’s Phil…

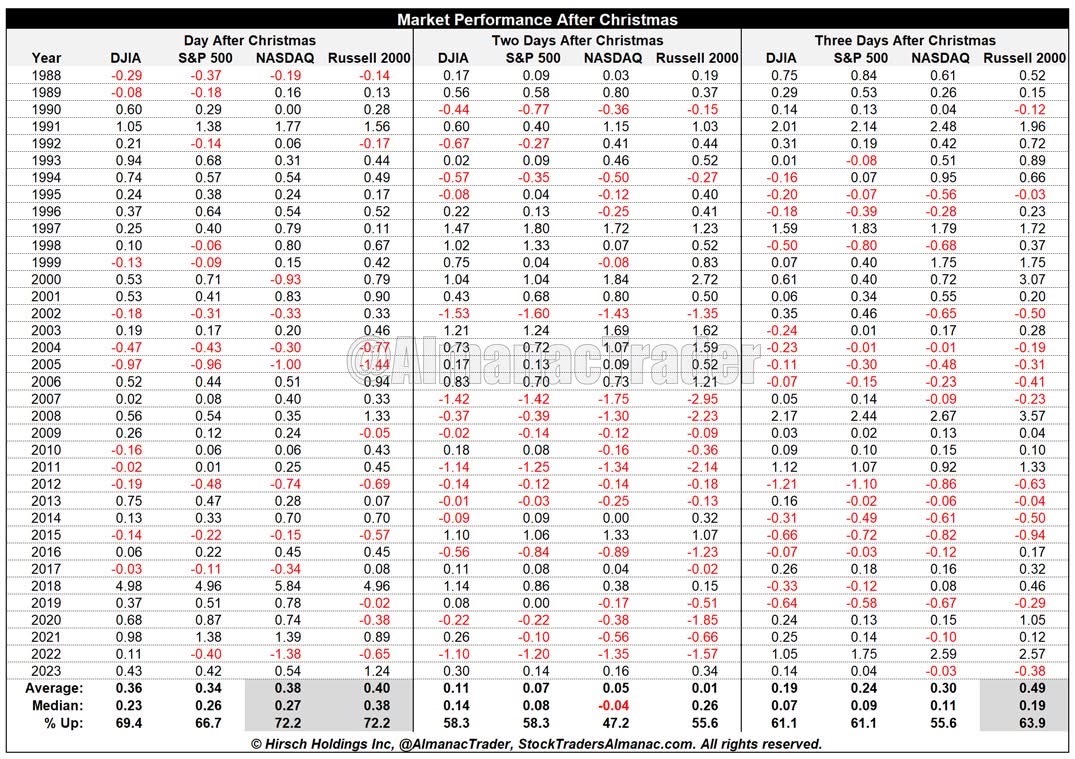

Chart from Stock Traders Almanac

Important Question: Are you ready to trade smarter?

When you’re ready – Dive Deeper Into a Profitable Rules Based Trading System

This Proven 3-Step “10 min/Day” 6-Figure Unconventional Recession Proof SPX Income System Unlocks $500-$5,000+ Days FAST! …

Deeper Dive Analysis:

The Santa Claus Rally, discovered by Yale Hirsch in 1972, spans the last five trading days of the year and the first two trading days of the New Year. On average, it delivers 1.3% gains on the S&P 500.

More than a seasonal boost, the rally is a vital indicator for the year ahead. Historically, years without a rally often preceded bearish markets or sharp declines later on. As Yale famously said: “If Santa Claus Should Fail To Call, Bears May Come to Broad and Wall.”

Key Stats for the Day After Christmas:

- NASDAQ & Russell 2000: Up 72.2% of the time since 1988, with average gains of +0.38% (NASDAQ) and +0.40% (R2K).

- S&P 500 & DJIA: Slightly less bullish but still positive.

Looking Ahead:

- Two Days Post-Christmas: Markets less bullish; NASDAQ typically underperforms.

- Three Days Post-Christmas: R2K small caps shine, advancing 63.9% of the time, with a +0.49% average gain.

- From 1950–1985: Last 5 trading days of the year saw the S&P 500 up 34 of 36 years, averaging +1.24%.

- From 1986–2023: Gains occurred 21 of 38 years, averaging +0.44%.

This seasonal trend reinforces the importance of December in shaping market sentiment, providing both opportunities and early warnings for traders.

Fun Fact

December is not only famous for Santa’s Rally but also for being the strongest month for small-cap stocks. Historically, the Russell 2000 outpaces the S&P 500 in December as investors scoop up smaller companies with growth potential for the new year.

Interestingly, while the S&P 500 thrives on steady optimism, the Russell 2000 thrives on investors’ appetite for risk. This dual dynamic keeps December one of the most fascinating months for market watchers.

Happy trading,

Phil

Less Brain More Gain

…and may your trades be smoother than a cashmere codpiece