NFP Friday – First of the Year – Overhyped Nothing Burger or Market Mover?

Ahoy there, Trader! ⚓️

Ahoy there, Trader! ⚓️

It’s Phil…

Russell finally popped its NATH cherry.

First new all-time high of 2026 for Uncle Russell, joining Dow at the summit whilst SPX and Nasdaq continue to dither near their highs. Nasdaq is clearly lagging – and despite everything holding near all-time highs, nothing has really changed.

I still think something explosive is around the corner.

If the Venezuela situation wasn’t going to be the catalyst for it, then I’m scratching my head as to what it might be. Whatever happens – gonna be fun.

Anyway, whilst I was out and about with a little ramble in the woods yesterday, not paying much attention to the markets, the insiders feed exploded with wins.

Again.

Awesome job, team. The system doesn’t need me watching.

PopPop.

NFP Friday. Popcorn ready. Scroll down for the setup.

Market Briefing:

Multi-Market Snapshot

| Instrument | Status | Level | Notes |

|---|---|---|---|

| ES | NATHs | 6,998.25 | Holding highs |

| YM | NATHs | 49,876 | Leading |

| NQ | Lagging | 25,727 | Clearly behind |

| RTY | NATH! | 2,621.2 | First of 2026! |

| GC (Gold) | Strong | 4,478.9 | Still bid |

| CL (Oil) | Bounce | 58.00 | Off the lows |

| VIX | Asleep | 15.68 | Complacent |

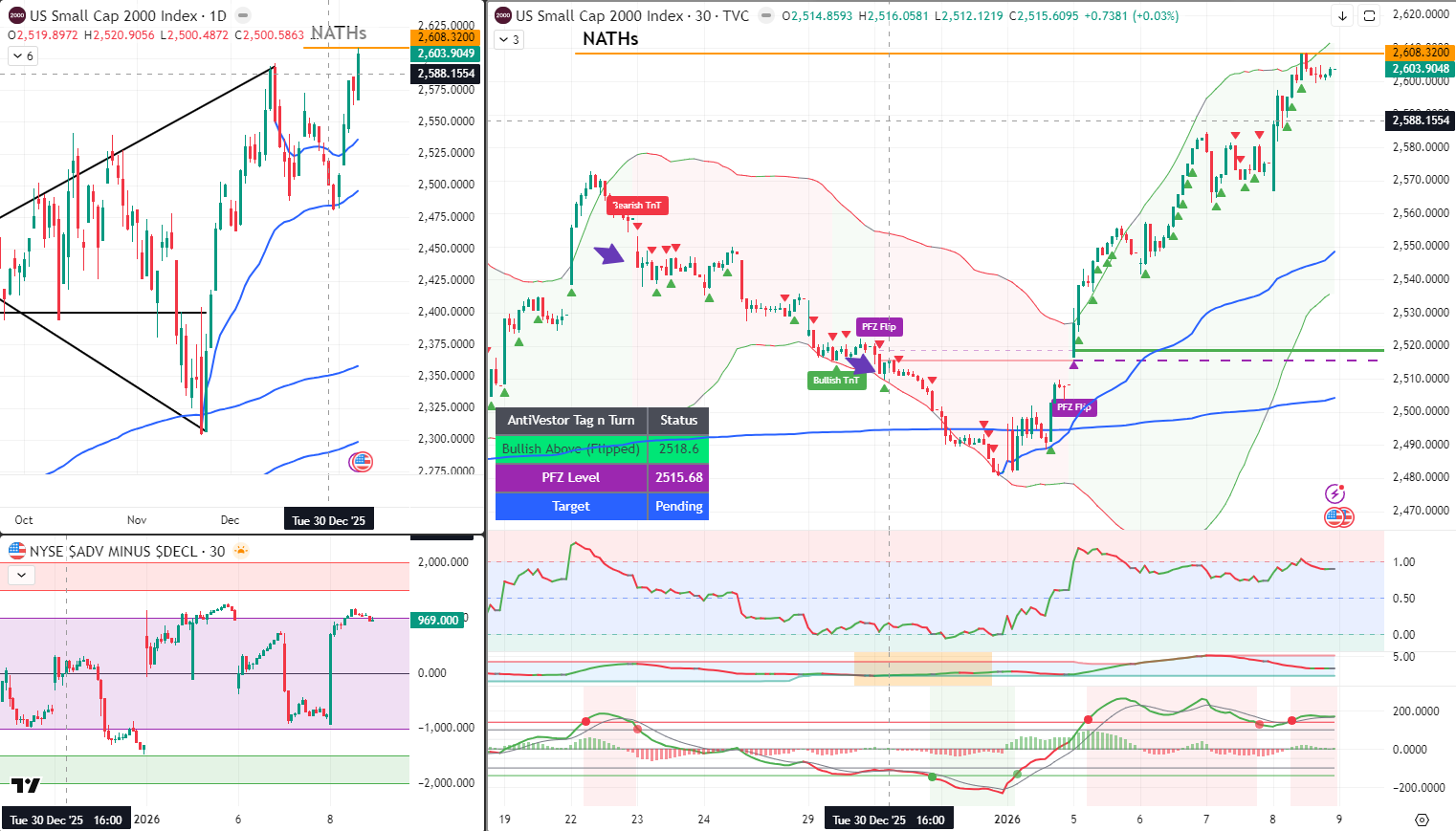

RUT – The NATH Finally Arrives

Uncle Russell popped another NATH yesterday. First one of the year. Joining Dow at the summit.

And with it closing near the highs? I’d expect a big Friday finish.

| TnT Status | Level |

|---|---|

| Direction | Bullish (Flipped) |

| Bullish Above | 2518.6 |

| PFZ Level | 2515.68 |

| Target | Pending |

| Current | ~2,608 (NATHs) |

The swing is working. The NATHs are here. The momentum is bullish.

SPX – Sitting on AVWAP

SPX remains bullish and sitting on its anchored VWAP, looking poised for the next move higher.

| TnT Status | Level |

|---|---|

| Direction | Bullish |

| Bullish Above | 6850.53 |

| PFZ Level | 6828.99 |

| Target | 6982.49 |

| Current | ~6,921 |

The Tag n Turn remains bullish. Sitting on support. Waiting for the push.

Nasdaq – The Laggard

Nasdaq is clearly lagging. Despite holding near all-time highs, it’s not leading. Not following with conviction either. Just… there.

Sometimes the laggard catches up explosively. Sometimes it drags everyone else down. We’ll see which story plays out.

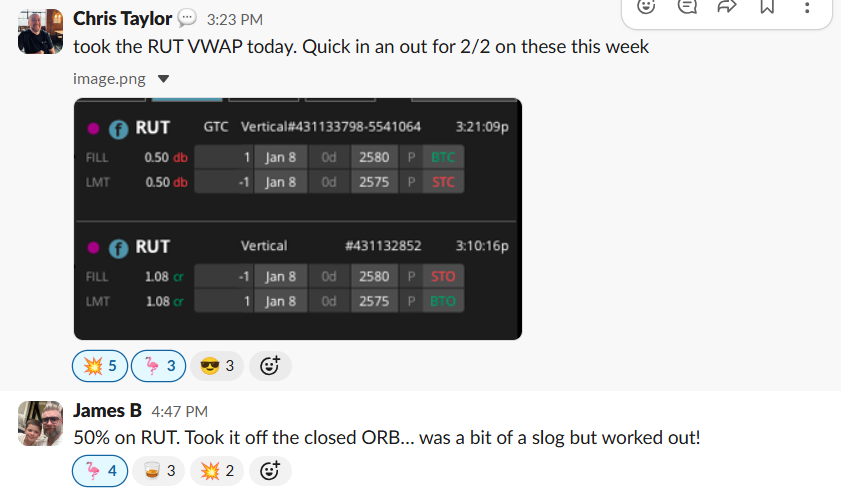

Yesterday’s Wins – Woods Walk Edition

I was rambling through the woods. Not watching screens. Not checking charts.

The Discord feed? Exploded anyway.

| Name | Ticker | Result | Notes |

|---|---|---|---|

| Colin H. | RUT | 97% ROC | Tuesday’s 1DTE closed |

| Duncan G. | RUT + SPX | 50% + 50% | Both PP, “grind with SPX” |

| Zach | RUT | 50% | VWAP pullback entry |

| Chris T. | RUT | Win | VWAP trade, “2/2 this week” |

| James B. | RUT | 50% | Closed ORB, “bit of a slog” |

| Andy D. | RUT | 80%! | Monster return |

| Richard H. | RUT | 50% | ORB 20 PP |

“Great job, everyone! You all inspire me. I haven’t ventured into the ORB 20s but plan to join after a month of paper trading.” – Mary

“Quality guys nice work… I was with you James off the bo bar, got there eventually!” – Colin H.

The system keeps paying. Whether I’m watching or not.

*Screen shots below

NFP Friday – The Big One

Non-Farm Payrolls at 8:30am – Forecast 154K

First NFP of the year. All eyes will be focused on this one.

But here’s the thing – given the government shutdown at the end of last year, the writing off or outright ignoring of the usual stats and reports releases… it’s going to be interesting to see this one.

The data might be skewed. The reaction might be muted. Or it might be the catalyst we’ve been waiting for.

Or it’s just going to be an over-anticipated nothing burger.

Stay tuned and keep your popcorn ready.

Today’s Calendar

| Time (ET) | Event | Forecast |

|---|---|---|

| 8:30am | Non-Farm Payrolls | 60-70K |

| 8:30am | Unemployment Rate | 4.5% |

| 10:00am | UoM Consumer Sentiment | – |

In Other News…

Value Leads For First Time Since 2007, Markets Act Surprised

Dow near record, Nasdaq lags. Defence whipsaws on Trump budget. Jobs + tariff ruling = binary Friday.

Tech rotation accelerated Thursday as value stocks led for first time this millennium—Dow +270 to 49,266 nearing record whilst Nasdaq fell 0.44% proving growth dominance ending shocks everyone who ignored warnings. Dual catalysts loom Friday: December jobs and potential Supreme Court tariff ruling creating binary setup where both outcomes already priced in contradictorily. VIX at 18 signals concern whilst 90% expect Fed January hold suggesting certainty about everything except what matters.

When Tech’s Two-Decade Run Hits Pause

Nvidia, Palantir, Broadcom led Thursday tech declines as rotation to value materialized after years of predictions. Top 2026 performers reveal pattern: Sandisk +32%, Moderna +19%, LAM Research +16%, Micron +13%—semiconductors and biotech leading growth whilst AI darlings lag. Markets discovering revolutionary concept that valuations occasionally mean revert shocking analysts who declared tech dominance permanent in 2024.

Defence Stocks Whipsaw on $1.5T Budget Rumours

Defence sector whipsawed on Trump’s $1.5T budget proposal before recovering—markets processing potential cuts then deciding cuts won’t happen proving every headline triggers trade then reversal. Venezuela military seizures completely ignored by energy sector with WTI below $60 demonstrating geopolitical events only matter when convenient for narrative.

Apple’s Credit Card Musical Chairs

Apple fell 1% premarket as JPMorgan takes credit card program from Goldman—game of hot potato where nobody wants consumer credit risk. Palantir +2% on BofA Buy reiteration with $255 target proving analyst upgrades still move stocks during rotation. Globus Medical +9% on Q4 prelims showing small-cap strength.

⚖️ Dual Friday Catalysts: Jobs + Tariff Ruling

December NFP and potential Supreme Court tariff decision create binary Friday setup—options showing defensive positioning whilst VIX 18 suggests measured concern not panic. Gold steady $4,470 ahead of BCOM rebalancing. 90% expect Fed January hold meaning only surprise possible is non-surprise surprising markets. Treasury curve stable signalling confidence despite defensive options flows.

☕ Hazel’s Take

Value leads first time since financial crisis, dual catalysts Friday, defence whipsaws, Apple loses credit card. When tech rotation shocks everyone who saw it coming and binary outcomes already priced contradictorily, probably acknowledging Friday determines if value rally real or head-fake.

—Hazel, FinNuts

Fun Fact:

If the Supreme Court strikes down Trump’s IEEPA tariffs, importers could seek refunds on over $133 billion already collected. That’s more than the entire GDP of countries like Kuwait, Morocco, or Ecuador.

Rumour Has It…

The FinNuts team prepares for NFP Friday…

“So this is it,” Percy announced, adjusting his party hat. “The big one. NFP Friday.”

Wallie checked his screens for the fourteenth time in three minutes. “First NFP of the year. Government shutdown probably messed with the data. Could be anything.”

“Could be a nothing burger,” Mac offered, not looking up from his newspaper.

“It’s never a nothing burger when you want it to be a nothing burger,” Hazel observed, already on her fourth coffee. “And it’s always a nothing burger when you expect fireworks.”

“So which is it today?” Kash asked.

“Yes.”

Percy had set up a popcorn machine in the corner. It was making concerning noises. “Phil said keep popcorn ready. I’m keeping popcorn ready.”

“Phil was walking through woods yesterday whilst we all made money,” Wallie muttered. “Ninety-seven percent ROC on Colin’s 1DTE. Eighty percent on Andy’s RUT. The man goes hiking and we hit the jackpot.”

“That’s the point though, isn’t it?” Mac finally looked up. “System works whether you’re watching or not. Whether you’re hiking or not. Whether you’re eating Percy’s questionable popcorn or not.”

“My popcorn is not questionable!”

“It’s smoking, Percy.”

“That’s… flavour smoke.”

Hazel pulled up the RUT chart. “New all-time highs yesterday. First of the year. Joining Dow at the summit. SPX sitting on AVWAP looking ready.”

“And Nasdaq?” Kash asked.

“Lagging. Clearly. Not leading, not following with conviction. Just… there.”

“Sometimes the laggard catches up explosively,” Mac said.

“Sometimes it drags everyone down,” Wallie countered.

“And sometimes,” Percy interjected, rescuing his now-flaming popcorn machine, “you just eat your popcorn and watch what happens.”

Everyone considered this.

“That was almost wise, Percy.”

“I have my moments. Popcorn?”

This is entirely made-up satire. Probably!

Breaking scoops courtesy of the Financial Nuts Newswire-because who needs sanity?

Fun Fact:

The First NFP of the Year Effect

The January Non-Farm Payrolls report often carries outsized importance – not because the data itself is more meaningful, but because it sets the narrative tone for the year.

Traders and analysts use it as a “first look” at labour market health after the holiday hiring distortions clear. Seasonal adjustments are at their most aggressive in January, which means the headline number can swing wildly from expectations.

The historical pattern? January NFP surprises (in either direction) tend to create larger-than-average market reactions. Whether that holds today with the government shutdown data questions remains to be seen.

But one thing’s consistent – the anticipation often exceeds the reality.

[Source: Bureau of Labor Statistics – Employment Situation Technical Notes]

Happy trading,

Phil

Less Brain, More Gain

…and may your trades be smoother than a cashmere codpiece

p.s. There are 3 ways I can help you…

- Option 1: The SPX Income System Book (Just $12)

A complete guide to the system.

Written to be clear, concise, and immediately actionable.

>> Get the Book Here

- Option 2: Full Course + Software Access – 50% off for Regular Readers – Save $998.50

Includes the video walkthroughs, tools for TradeStation & TradingView, and everything I use daily. Plus 7 additional strategies

>> Get DIY Training & Software

- Option 3: Join the Fast Forward Mentorship – 50% off for Regular Readers – Save $3,000

>> Join the Fast Forward Mentorship – trade live, twice a week, with me and the crew. PLUS Monthly on-demand 1-2-1’s

No fluff. Just profits, pulse bars, and patterns that actually work.